When you hear "mortgage," you probably think of buying a home. But when a business needs to buy or upgrade its physical space, it enters a whole different world: commercial real estate financing.

So, what exactly is a commercial real estate (CRE) loan? At its core, it’s a loan used to buy, build, or renovate property that's meant for business, not for living in.

What Is a Commercial Real Estate Loan?

Let's use an analogy. A residential mortgage is like a reliable, off-the-shelf sedan—it's designed for a single, straightforward purpose: getting you home. A commercial real estate loan, on the other hand, is more like a custom-built piece of heavy machinery. It's engineered for a specific, heavy-duty job: generating income.

This difference is everything. When you apply for a home loan, the bank cares about your personal income and credit score. But with a commercial loan, the lender's primary focus shifts to the property's ability to make money. The big question isn't just "Can you afford this?" but "Will this office building, warehouse, or retail center generate enough cash flow to pay for itself and then some?"

The Purpose of a CRE Loan

For businesses, a CRE loan isn't just about getting a roof over their heads; it's a strategic move to grow. It's about securing a tangible asset that can drive revenue and cement their place in the market.

Companies typically use these loans to:

- Buy property: This could be anything from an office for a growing law firm to a multi-unit apartment building for an investor.

- Develop land: Think of a construction firm that needs financing to build a new shopping center from the ground up.

- Expand or renovate: A manufacturer might use a CRE loan to add a new production wing to its factory, or a hotel owner could finance a major lobby and room upgrade.

- Refinance an existing loan: Businesses often refinance to lock in a better interest rate or get more favorable terms on a property they already own.

Just how vital are these loans? The total outstanding commercial and multifamily mortgage debt in the U.S. hit an incredible $4.79 trillion at the end of last year. That’s a testament to how fundamental this type of financing is for our economy.

A commercial real estate loan isn’t just about buying a building; it’s an investment in your company’s future revenue stream. The property itself becomes a key player in your business's financial success.

Why It's Different from a Home Loan

The fundamental split between a commercial loan and a home loan comes down to a single question: who (or what) is paying it back?

With a home loan, you are the source of repayment. Your salary, your savings—it’s all on you. With a commercial property, the building itself is expected to be the primary repayment source, whether through tenant rent or the income from the business operating there.

This is why the approval process is so much more intensive. Lenders dig deep into cash flow projections, local market trends, vacancy rates, and the quality of existing tenants. They're not just evaluating you as a borrower; they're underwriting an entire business investment. It’s this sharp focus on income potential that makes commercial real estate lending such a unique and powerful tool for any growing business.

What Are My Commercial Real Estate Loan Options?

Not all business needs are the same, and neither are commercial real estate loans. Think of it like a toolbox: you wouldn't use a sledgehammer for a task that needs a precision screwdriver. Picking the wrong financing can cause serious headaches down the road, so understanding your options is the first step toward securing a property that actually helps you grow.

Every loan is built to solve a specific business problem. Whether you need the stability of a long-term mortgage for your company's headquarters or a quick injection of cash to jump on an investment opportunity, there’s a loan product designed for the job.

Let's break down the most common ones you'll encounter.

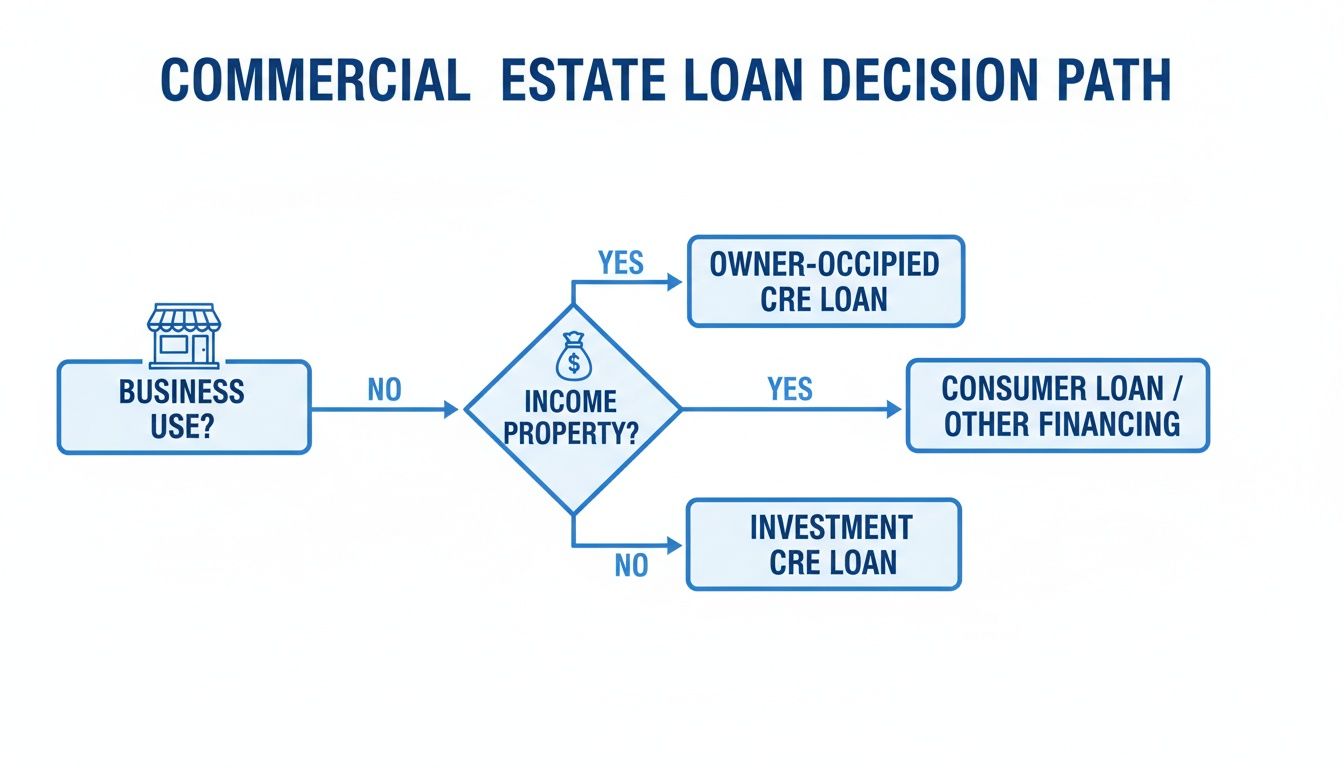

The first big question you need to answer is: are you buying the property for your own business to use, or as an investment to generate rental income? This single decision sends you down one of two very different financing paths.

As you can see, the property's core purpose is the critical fork in the road. It determines the type of loan you'll seek and how a lender will evaluate your application.

Traditional Commercial Mortgages

This is the classic, go-to option for buying or refinancing a property you plan to hold onto for the long haul. It functions much like a residential mortgage, but it’s tailored specifically for commercial properties.

- Best For: A successful manufacturing firm that wants to buy its first dedicated facility. The plan is to operate there for the foreseeable future, so a stable, long-term loan is a perfect match.

- Key Features: These loans usually come with terms of 5 to 20 years. However, the payments are often calculated (or "amortized") over a much longer period, like 25 or 30 years, which keeps the monthly payments lower and more manageable.

SBA 7(a) and 504 Loans

The Small Business Administration (SBA) doesn't issue loans itself. Instead, it acts as a guarantor, promising to cover a portion of the loan if the borrower defaults. This significantly reduces the risk for partner banks, making them more willing to offer great terms to small businesses.

- SBA 7(a) Loans: This is the SBA's most popular and flexible program. You can use the funds for almost anything, from buying a building to refinancing old debt. A huge plus is that you can often roll working capital into the same loan.

- SBA 504 Loans: This one is laser-focused on acquiring major fixed assets like real estate or heavy machinery. The financing is split into three parts: 50% from a traditional bank, 40% from a Certified Development Company (CDC), and just 10% from you, the borrower. This structure is a game-changer, often locking in a low, fixed interest rate on the CDC portion.

Here's a real-world example: A popular local restaurant wants to buy its building instead of continuing to lease. An SBA 504 loan lets the owner secure the property with a very small down payment, freeing up cash for critical needs like inventory and marketing.

Bridge and Hard Money Loans

Sometimes, you just need cash, and you need it yesterday. Bridge loans and hard money loans are short-term solutions built for speed, stepping in when traditional lenders are too slow to act on a time-sensitive deal.

A bridge loan does exactly what its name implies: it "bridges" a temporary funding gap. Imagine an investor finds a great deal on an office building but needs to close in two weeks. They can use a bridge loan to buy it fast, then take their time renovating and finding tenants before refinancing into a permanent mortgage.

Hard money loans are a bit different. Lenders focus almost entirely on the property's value (the "hard" asset) rather than the borrower's credit score. This makes them ideal for fixing and flipping distressed properties. But this speed and flexibility come at a cost: interest rates are much higher, and terms are very short, usually just 1 to 3 years.

Comparing Commercial Real Estate Loan Options

With several paths to take, it can be helpful to see the options side-by-side. This table breaks down the core features of each loan type to help you quickly identify which one might be the best fit for your specific goal.

| Loan Type | Best For | Typical Term Length | Key Advantage |

|---|---|---|---|

| Traditional Commercial Mortgage | Long-term owner-occupied or investment property purchases | 5-20 years | Predictable payments and stable terms. |

| SBA 7(a) Loan | Buying property while also needing funds for other business expenses | 10-25 years | Highly flexible; can include working capital. |

| SBA 504 Loan | Purchasing major assets (like real estate) with a small down payment | 10-25 years | Very low down payment (10%) and favorable fixed rates. |

| Bridge Loan | Quickly acquiring a property before long-term financing is secured | 6 months - 3 years | Speed and flexibility to close deals fast. |

| Hard Money Loan | Time-sensitive investments, fix-and-flips, or when credit is an issue | 1-3 years | Funding is based on property value, not borrower credit. |

Ultimately, the right loan depends entirely on your situation—your timeline, your financial health, and what you plan to do with the property. Each of these tools is designed for a specific job, and choosing the right one is the first step toward a successful real estate investment.

What Lenders Look For to Approve Your Loan

Trying to secure a commercial real estate loan can feel like putting together a complex puzzle. Lenders aren't just looking at one number on a spreadsheet; they’re building a complete picture of the deal to weigh the risk against the potential reward. Once you understand what they’re looking for, the whole process becomes much clearer, and you can position your application for success.

Think of it this way: when a lender gives you a loan, they're essentially becoming a financial partner in that property. They need to feel confident that their investment is secure and that the property itself is a solid asset. To get that confidence, they lean on a few key metrics to assess the financial health of the deal.

The Debt Service Coverage Ratio

The most critical number in the lender's playbook is the Debt Service Coverage Ratio (DSCR). It sounds technical, but the idea is simple: it measures whether the property generates enough income to pay its own bills. Lenders take the property’s Net Operating Income (NOI) and divide it by the total annual loan payments.

A DSCR of 1.0 means the property brings in just enough cash to cover the mortgage—and not a penny more. That’s far too close for comfort for any lender. They need to see a cushion.

Most lenders want to see a DSCR of 1.25 or higher. A 1.25 ratio means the property generates 25% more cash than what’s needed to make the loan payments. This buffer demonstrates that you can handle unexpected vacancies or maintenance costs without missing a payment.

Loan-to-Value Ratio and Your Equity

Next up is the Loan-to-Value (LTV) ratio. This simply compares the loan amount to the property's appraised value. It’s the lender’s way of making sure you have enough "skin in the game."

For example, if you’re buying a property appraised at $1 million and the lender offers a $750,000 loan, your LTV is 75%. That other $250,000 is your down payment—your equity stake. A lower LTV is always less risky for the lender, which is why a larger down payment can make your application significantly more attractive.

Business Financials and Credit History

While the property’s ability to perform is paramount, your own financial history is still a huge piece of the puzzle. Lenders will dig into:

- Business Credit Score: This shows how well your company has managed its debts and paid its suppliers.

- Personal Credit Score: As the business owner, your personal financial habits are often seen as an indicator of your discipline and reliability.

- Financial Statements: Get ready to hand over at least two to three years of business tax returns, profit and loss statements, and balance sheets.

These documents help paint a picture of your business’s stability and your skill as an operator. Lenders want to see a consistent history of profitability and responsible financial management.

The Rise of Alternative Lenders

For many small and mid-sized businesses, meeting the rigid criteria of a traditional bank can be a real roadblock. This is where alternative lenders and specialized brokers like FSE have opened up a world of new possibilities. The lending market has changed, and non-bank lenders are playing a bigger role than ever.

During a recent market upswing, U.S. commercial real estate investment volume hit $112.1 billion. In that period, alternative lenders funded 37% of all non-agency loans, outpacing banks, which accounted for 31%. As detailed in a capital markets recovery analysis on CBRE.com, this shift is great news for business owners who need more flexible underwriting and faster closing times.

Brokers have relationships with a wide network of these modern lenders, giving them access to partners who can look beyond a single metric. A good broker can help tell your story, highlighting strong cash flow or deep industry expertise to make up for a credit score that isn't perfect. That personalized approach is often exactly what’s needed to secure the financing you need to seize a growth opportunity.

The Step-by-Step CRE Loan Application Process

Getting a commercial real estate loan might feel like navigating a maze, but it’s really just a roadmap with clear, sequential steps. If you know what’s coming around the next turn, the whole journey becomes far less intimidating. Think of it less as filling out forms and more as building a compelling case for why your business and the property are a solid bet.

Good preparation is your single greatest asset here. It’s what separates a smooth, successful application from one that gets bogged down in delays and requests for more information.

Stage 1: The Pre-Application Phase

Long before you even pick up the phone to call a lender, the real work begins. This is your chance to get your financial story straight and gather all the evidence to back it up. Laying a strong foundation here makes the rest of the process much more stable and predictable.

In this stage, you're essentially building your loan package. Lenders will want to see everything, digging into both your business's financial health and your personal standing.

Here’s what you’ll need to have ready:

- Business Financials: Gather at least two to three years of business tax returns, plus up-to-date profit and loss (P&L) statements and balance sheets.

- Personal Financials: You'll need personal tax returns for all key owners (anyone with 20% or more ownership is the typical threshold) and a detailed personal financial statement.

- Property Information: Have all the details on the property you’re buying. This includes the purchase agreement, the current rent roll if it’s an income-producing property, and its operating statements.

- Business Plan: Put together a straightforward summary explaining how this property fits into your larger business strategy and what you project for its future.

Stage 2: Formal Application and Underwriting

With your documents organized, it’s time to submit the formal application. This is where the lender’s team takes the wheel. The file lands on an underwriter's desk, and they begin the deep dive into your numbers—a process known as underwriting.

The underwriter acts like a financial detective, verifying every piece of information to ensure the loan aligns with their institution's risk tolerance. They'll calculate your DSCR, verify the LTV against their standards, and run credit checks. A crucial step here is ordering a third-party appraisal to get an official, unbiased market value for the property. This appraisal confirms the collateral is worth what you—and the lender—think it is.

Underwriting can feel like a black box, especially with old-school banks. It often involves a lot of waiting, punctuated by requests for just one more document. The keys to getting through it are patience and responding to any queries as quickly as possible.

Stage 3: The Loan Commitment and Closing

If the underwriter gives their stamp of approval, the lender issues a loan commitment letter. This isn't just a pre-approval; it’s a formal offer. It will clearly spell out the loan amount, interest rate, term, and any other conditions you must meet before closing. It's essential to review this document with your attorney or trusted advisor before you sign on the dotted line.

The finish line is the closing. This is the official meeting where all legal documents are signed, funds are wired, and the property title is transferred into your name. It’s the satisfying conclusion to weeks, and sometimes months, of hard work.

Traditional Banks vs. Modern Brokers: A Tale of Two Timelines

While that’s the standard path, the time it takes can vary wildly depending on your lending partner. Traditional banks are notoriously thorough, which is a good thing, but their process is often slow, easily stretching 60 to 90 days or even longer. When you’re trying to jump on a great opportunity, that kind of delay can kill the deal.

Luckily, the lending landscape is changing. As noted in a recent industry analysis, a surge in lending activity not seen since early 2023 shows alternative lenders are deploying capital and now closing a larger share of non-agency loans than banks. You can explore more on this trend in Deloitte's commercial real estate outlook. This market shift is great news for businesses that need to move faster than the old guard allows.

This is where a modern broker like FSE comes in. By tapping into a wide network of these more nimble alternative lenders, they can find flexible financing partners who understand the need for speed. This often means getting a preliminary decision in as little as 24 hours and having funds ready in a matter of days, not months. For a growing business, that speed is a true competitive advantage.

How a Broker Can Streamline Your Financing

Trying to find the right commercial real estate loan on your own can feel like navigating a maze blindfolded. You know where you want to end up, but every turn seems to lead to a dead end, a complex puzzle, or a flat-out "no." This is where a great commercial finance broker comes in. Think of them less as a middleman and more as your expert guide.

For any business that doesn't fit neatly into a traditional bank's very small box, a broker is often the key to getting a deal done. They know how to tell your story, frame your strengths, and connect you with lenders who see the opportunity, not just the risk.

Access to a Wider Lender Network

The single biggest advantage of working with a broker is their network. While you might know a few local banks, a seasoned broker has relationships with dozens—sometimes hundreds—of different funding sources. This includes private credit funds, family offices, and other alternative lenders you’d never find on your own.

This access is more critical than ever. With an estimated $300 billion in U.S. commercial property loans coming due in late 2025, and big banks pulling back on lending, competition for capital is fierce. An MSCI report on real estate lending dynamics highlights this exact pressure, noting that non-bank lenders are stepping in to fill the gap. A broker is your direct line to these vital funding partners.

A great broker doesn't just find you a loan; they find you the right loan. They create a competitive marketplace where lenders are vying for your business, which is how you get the best possible rates and terms.

Saving Time and Getting Expert Advice

As a business owner, your time is your most valuable resource. Sinking weeks into researching lenders, filling out endless applications, and chasing down answers is a distraction you can't afford. A broker takes all of that off your plate.

They become your single point of contact, managing the entire process from start to finish. But their real value is in the strategy they bring to the table. They’ll help you:

- Structure the Deal: They know how to package your loan request to make it as attractive as possible to underwriters.

- Find the Right Fit: They won't waste your time with lenders who aren't a good match for your industry, credit profile, or project type.

- Negotiate Terms: Using their deep market knowledge, they go to bat for you to secure better rates, fees, and covenants.

Some people hesitate, thinking a broker just adds another fee. In reality, a good broker more than pays for themselves. The money they save you by securing a slightly lower interest rate or more flexible terms can far outweigh their commission, delivering a powerful return on your investment.

Your Top Commercial Real Estate Loan Questions, Answered

Stepping into the world of commercial real estate financing can feel like learning a new language. You're busy running your business, and it's natural to have questions. Let's clear up some of the most common ones so you can move forward with clarity and confidence.

How Long Does Funding Usually Take?

The timeline for getting a commercial real estate loan really hinges on who you borrow from. If you walk into a traditional bank, be prepared to settle in for a while. Their process is thorough, which is a good thing, but it's also slow, often taking a full 60 to 90 days from the day you apply to the day you close. They have layers of approval and a long list of third-party reports to get through, like appraisals and environmental checks.

But the old way isn't the only way anymore. A modern broker with a network of different lenders can often get you an answer much faster. It's not uncommon to get a preliminary "yes" or "no" within 24 hours and have the funds in hand in a matter of days. When a great opportunity pops up and you need to act fast, that speed can make all the difference.

The bottom line is simple: your choice of lender is the biggest factor in your funding timeline. If speed is a priority, you need to look beyond the bank on the corner.

Do I Need a Huge Down Payment?

Everyone hears about the massive down payments required for commercial property, but that's not the whole story. Yes, for most conventional commercial real estate loans, you'll be expected to put down 20% to 30% of the purchase price. Lenders want to see that you have some "skin in the game," as it lowers their risk.

However, there are fantastic loan programs out there specifically designed to make property ownership more attainable.

- SBA 504 Loans: These are a true game-changer for many small businesses, allowing you to get into a property with as little as 10% down.

- Seller Financing: In some situations, the seller might be willing to finance part of the deal themselves. This can significantly reduce the cash you need to bring to the closing table.

Don't let the idea of a huge down payment stop you before you start. It’s always worth exploring all the different loan types available.

How Do Lenders View New vs. Established Businesses?

Lenders definitely look at new and established businesses through a different lens. For a business that's been around for years with a solid track record of profits and consistent cash flow, it's an easier bet for the lender. They can look at your financial history and feel comfortable predicting how you'll perform in the future.

For a brand-new business or a startup, there's no history to review. So, lenders pivot and look at other things. Your business plan has to be rock-solid. They'll want to see your personal industry experience and check your personal financial health. Projections for how the property itself will generate income become absolutely critical. Getting a commercial real estate loan as a new business is certainly tougher, but with a great plan and strong personal credit, it's far from impossible.

Ready to explore your options without the long waits and rigid requirements of a traditional bank? The team at FSE - Funding Solution Experts can connect you with over 50 lending partners to find the right financing for your property. Get a no-obligation decision in as little as 24 hours. Learn more and apply in minutes at FSE.