When we talk about improving your business cash flow, we're really talking about three core activities: getting cash in the door faster, being smarter about how it goes out, and knowing what’s coming down the road. It boils down to tightening up everything from invoicing and collections to expense management and inventory control. The goal is simple: make sure the cash you have on hand is always more than what you owe right now.

Why Cash Flow Is Your Most Important Business Metric

It’s incredibly common for business owners to mistake profit for cash flow, but that’s a dangerous mix-up. Your P&L statement might be showing a fantastic profit, but you can't pay your employees, suppliers, or rent with paper profits. You need actual cash.

This is the exact trap so many successful businesses fall into—they become "profit-rich" but "cash-poor."

Think about it this way: you run a construction company and just wrapped up a huge project. You send the client a big invoice, and your books look amazing. But the client is on Net 60 payment terms. For the next two months, you have zero cash from that job to cover payroll, buy materials for the next project, or make your equipment lease payments. That painful gap between earning the revenue and seeing the cash is the cash flow problem in a nutshell.

The Real-World Impact of Cash Flow

Negative cash flow isn't just a number on a spreadsheet; it creates real stress and can paralyze a business, forcing you into tough corners. When cash gets tight, your options shrink.

- Growth Stalls: You can’t afford to hire the key people you need to expand your services or land bigger clients.

- Opportunities Missed: Your supplier calls with a one-time 20% discount on a bulk order, but if you don't have the cash, you can't jump on those savings.

- Operational Friction: You start putting off essential equipment repairs or cutting back on marketing, slowly chipping away at your ability to compete.

I've seen it firsthand in industries like trucking and logistics. A single delayed payment from a major customer can mean a fleet owner can't afford fuel. The entire operation grinds to a halt, all because of one hiccup in the cash cycle.

Healthy cash flow is the operational lifeblood of your business. It gives you the flexibility to handle surprises, the agility to grab opportunities, and the stability to build a company that lasts.

On the flips side, positive cash flow is what fuels momentum. It’s what allows a restaurant to build a new patio to double its seating capacity or an e-commerce store to load up on inventory right before the holiday rush. Learning how to improve business cash flow isn't just a financial exercise—it's the most fundamental skill for survival and growth.

Finding the Leaks in Your Cash Flow

Before you can fix a cash flow problem, you have to play detective. The money you’ve earned is getting stuck somewhere between the sale and your bank account, and your job is to figure out exactly where that is. This isn't about becoming a CPA overnight; it's a practical audit of your operations to pinpoint the bottlenecks.

Think about a construction firm where projects drag on just a little too long, client payments lag, and suddenly you’re scrambling to make payroll or pay a key supplier. This is a familiar story for countless business owners. In fact, uneven cash flow plagues a staggering 51% of small U.S. businesses. The good news? Much of this can be fixed. U.S. companies are sitting on an estimated $1.7 trillion in excess working capital, a huge portion of which is trapped in slow-paying invoices. You can find more data on this from the Kaplan Group's breakdown of small business financial challenges.

To start, you need to dig into a few key metrics. These aren't just abstract numbers; they’re diagnostic tools that tell the real story of your company's financial health.

To get a clear picture of where your cash is (and isn't), you need to look at a few specific areas of your business. The table below breaks down the most important metrics that act as your diagnostic toolkit.

Key Cash Flow Diagnostic Metrics

| Metric | What It Measures | Industry Example (Construction/Retail) |

|---|---|---|

| Days Sales Outstanding (DSO) | The average number of days it takes for customers to pay you after a sale. | A construction company's high DSO might reveal slow processing of change orders or delayed invoicing after project milestones. |

| Days Inventory Outstanding (DIO) | The average number of days your inventory sits on the shelves before being sold. | For a retailer, a high DIO could mean they have too much cash tied up in slow-moving or seasonal stock. |

| Days Payables Outstanding (DPO) | The average number of days it takes for you to pay your own suppliers and vendors. | A construction firm with a low DPO might be paying for materials long before they get paid by the client, straining their cash reserves. |

| Cash Conversion Cycle (CCC) | The total time it takes to convert your investments in inventory and operations back into cash from sales. | A retailer wants a short CCC, ideally selling goods before the supplier invoice is even due. |

By tracking these numbers, you move from guessing about your cash flow problems to precisely identifying them. Let's look at how to calculate and use them.

Diagnosing Your Accounts Receivable Health

How long does it really take to get paid after you’ve done the work? This is arguably the most critical question in cash flow management, and it’s answered by a metric called Days Sales Outstanding (DSO). When your DSO is high, it means your cash is stuck in your customers' bank accounts instead of yours.

You can calculate your DSO for any period (like a quarter) with a simple formula:

(Total Accounts Receivable / Total Credit Sales) x Number of Days in Period = DSO

Let's say a trucking company has $150,000 in accounts receivable and generated $500,000 in credit sales over the last 90 days. Their DSO is 27 days ($150k / $500k * 90). If their payment terms are Net 30, they're in pretty good shape. But if their terms are Net 15, a 27-day DSO signals a serious collections problem that needs immediate attention.

Your DSO is a direct reflection of your invoicing and collections efficiency. A rising DSO is an early warning siren—a sign you need to act before a cash crunch becomes a crisis.

Uncovering Hidden Inventory and Supplier Costs

Cash doesn't just get tied up in unpaid invoices. For businesses in retail, manufacturing, or even hospitality, a significant amount of cash sits on shelves as inventory or gets paid out to suppliers too quickly. Two metrics shine a light on these hidden leaks.

- Days Inventory Outstanding (DIO): This tells you how long, on average, your inventory sits around before it’s sold. A high DIO means cash is locked up in stock that isn't generating revenue.

- Days Payables Outstanding (DPO): This reveals how long you take to pay your own bills. A high DPO can be a strategic advantage—you’re effectively using your suppliers' credit to fund your operations. A low DPO, on the other hand, might mean you're paying bills faster than necessary and needlessly draining your cash reserves.

Imagine a restaurant owner who calculates their DIO and discovers it’s creeping up. This could point directly to over-ordering and food spoilage—they’re literally throwing cash in the trash. By tightening up their ordering process, they can immediately free up cash.

Putting It All Together with the Cash Conversion Cycle

The Cash Conversion Cycle (CCC) is the master metric that pulls everything together, giving you a holistic view of your operational efficiency. It measures the total time it takes for a dollar you spend on inventory or other operational costs to make its way back into your business as cash from a sale.

The formula is straightforward: CCC = DSO + DIO - DPO

A shorter cycle is always the goal. It means your business is a well-oiled machine, turning investments into cash quickly. A long or increasing CCC, however, tells you exactly where the friction is. If your DSO is the problem, you need to focus on collections. If DIO is too high, it's time to overhaul inventory management. This lets you apply targeted fixes instead of just guessing what's wrong.

Get Paid Faster by Accelerating Your Inflows

Once you've figured out where your cash is getting stuck, the most direct path to healthier cash flow is simple: get paid faster. Every single day you can shave off your Days Sales Outstanding (DSO) puts more cash in your pocket to run and grow the business.

This isn’t just about sending a few reminders. It’s about a fundamental shift in how you think about your entire invoicing and collections process.

Your goal should be to make paying you the easiest and most obvious thing for your customers to do. Friction is the enemy here. If a client has to dig up a checkbook, find an envelope, and track down a stamp, you've just created three opportunities for them to get distracted and put it off.

Rethink Your Invoicing Strategy

The speed of your cash flow is directly tied to the speed and clarity of your invoices. Sending an invoice a week after a job is done is basically giving your client an interest-free loan for seven days. You have to make the process immediate and precise.

Take a home services company, for instance—an HVAC repair business or a landscaper. They should be invoicing on the spot. I’ve seen companies completely transform their cash flow by simply equipping technicians with tablets to generate an invoice and take payment before ever leaving the property. This one change can slash DSO by 15 days or more.

The invoice itself needs to be bulletproof. Vague descriptions like "Services Rendered" just invite questions and, you guessed it, delays. Be specific. Instead of that, write: "Emergency HVAC Repair: Replaced faulty capacitor (Part #XYZ), 1.5 hours labor." There's no room for confusion.

Finally, make sure your payment terms are front and center. Don't just say "Net 30." State the exact date: "Due on October 25, 2025."

Your invoice is the starting gun for the payment race. A prompt, clear, and professional invoice sets the expectation that you expect prompt, clear, and professional payment in return.

Make Paying You Effortless

The easier you make it for customers to pay you, the faster you’ll get your money. In this day and age, relying only on paper checks is a guaranteed way to slow down your cash cycle. It's time to offer modern, frictionless payment options.

Think about implementing these to speed things up:

- Online Payment Portals: Put a secure payment link directly on your invoice so clients can pay instantly with a credit card or ACH transfer. It works. Research has shown that law firms accepting online payments see 85% of their invoices paid within a week.

- ACH (Automated Clearing House) Transfers: These direct bank-to-bank transfers are often cheaper than credit card fees and are a fantastic option for recurring B2B payments.

- Mobile Payment Systems: For any business with staff in the field, tools like Square or Stripe are non-negotiable. They allow for instant payment as soon as the work is done.

By offering a few convenient ways to pay, you remove any excuse for a delay. You're meeting your customers where they are, whether that's on their laptop at the office or on their phone in their driveway.

Incentivize and Automate Your Collections

Even with a perfect invoicing system, some payments will inevitably lag. This is where a systematic, automated collections process becomes your best friend. Manually chasing down every late invoice is a massive time-suck that you can't afford.

One of the most powerful tactics is to incentivize early payment. A classic approach is offering "2/10, net 30" terms. This simply means you give a 2% discount if the invoice is paid within 10 days; otherwise, the full amount is due in 30. That small discount is often a tiny price to pay for getting cash in the door 20 days sooner.

Pair that incentive with an automated reminder system. Most modern accounting platforms can be set up to send polite follow-ups on your behalf:

- Reminder #1: A friendly heads-up sent three days before the due date.

- Reminder #2: A firm but professional notice sent the day an invoice becomes overdue.

- Reminder #3: A more direct follow-up sent seven days past due, perhaps mentioning the late fees outlined in your terms.

This kind of system ensures no invoice falls through the cracks. It also professionalizes your collections, removing the awkwardness of making those follow-up calls and ensuring every client gets consistent communication. When you speed up your inflows, you directly improve your cash flow and give your business the fuel it needs to operate and grow.

Getting Smart About Where Your Money Goes

Boosting your cash flow isn't just about chasing new sales. That’s only half the equation. The other, equally critical half is about being strategic with every dollar that leaves your business. Managing your outflows intelligently is one of the most powerful levers you can pull. After all, a dollar saved is a dollar earned—and it stays right there in your account, ready for payroll, growth, or whatever comes next.

This isn't about nickel-and-diming your way to success or cutting essential corners. It's about operational discipline. The first step is a no-stone-unturned review of every single business expense. I'm talking about everything from your biggest line items, like inventory and rent, down to that $50 per month software subscription you forgot you even had. Those small leaks add up, and plugging them can make a huge difference.

Turn Your Suppliers into Partners

Think of your suppliers as more than just vendors. They're partners, and a strong relationship with them can unlock some serious financial breathing room. But you have to be the one to start the conversation.

One of the quickest wins? Negotiating better payment terms. If you're consistently paying your bills on Net 30 terms, what would it look like to push that to Net 45 or even Net 60? Getting an extra 15 or 30 days to pay gives you a crucial window to collect cash from your own customers before your payables come due. It's a simple change that can fundamentally shorten your cash conversion cycle.

Here are a few ways I’ve seen this work in practice:

- Play the Loyalty Card: If you've been a reliable, on-time customer for years, remind them of that. Good customers are hard to find.

- Commit to More Volume: Can you place a larger order or sign a longer-term contract? In exchange, ask for better terms or a small discount.

- Just Be Honest: If you’re navigating a temporary tight spot, a transparent conversation often works wonders. Many suppliers would rather agree to a temporary extension than lose a good customer.

For instance, a restaurant owner I worked with negotiated Net 45 terms with their main food distributor simply by agreeing to a six-month exclusive contract. Just like that, their cash position improved without changing a single other thing in their day-to-day operations.

Stop Letting Inventory Eat Your Cash

For any business holding physical goods, from e-commerce brands to construction firms, inventory is a notorious cash trap. Every single product sitting on a shelf or in a warehouse is cash that you can't use. Getting a handle on your inventory is non-negotiable if you want to free up that capital.

The idea is to adopt a just-in-time (JIT) approach, or as close to it as your industry allows. You want to hold the absolute minimum inventory required to meet customer demand without stocking out. This takes solid sales forecasting and great supplier communication for quick turnarounds. A retailer who spots a slow-moving product line and immediately runs a clearance sale is doing it right—they're turning stagnant dead weight back into liquid cash.

Inventory that isn't selling isn't an asset. It's a liability that actively drains your cash. Treat it that way and be ruthless about optimizing what you hold.

Perform a Full Expense Autopsy

Beyond your direct costs, your general operating expenses are probably hiding dozens of opportunities for savings. Block out some time every quarter to go through your P&L line by line and ask two simple questions: "Do we absolutely need this?" and "Are we getting the best possible price for it?"

Use this as a starting point for your audit:

- Software & Subscriptions: Do a full accounting of your SaaS tools. Are there overlapping services? Could you save money by switching to an annual plan or downgrading a tier you're not fully using?

- Marketing Budget: Get granular with your marketing analytics. Find the channels that are delivering a real return on investment (ROI) and reallocate funds from the ones that aren't.

- Utilities & Insurance: Don't just auto-renew. Shop around for your internet, phone, and insurance providers every single year. New customer deals are almost always better than what they offer to "loyal" ones.

- Rent & Leases: Is your lease renewal coming up in the next year? Start talking to your landlord now. A little market research on commercial vacancies in your area can give you significant leverage.

- Bank & Processing Fees: Pull your recent merchant statements and bank account analyses. Are you paying hidden fees? When was the last time you negotiated your credit card processing rate?

By systematically plugging these leaks in your outflows, you build a much more resilient, cash-healthy business. It's a proactive discipline that ensures you're not just making money, but actually keeping it.

Get Ahead of Problems with Cash Flow Forecasting

Running a business by reacting to financial surprises is exhausting and, frankly, not a strategy for long-term success. If you want to get a real handle on your cash flow, you have to get out of reactive mode and start thinking ahead. This is where a good cash flow forecast becomes your best friend. It’s the tool that turns a jumble of financial data into a clear roadmap.

And don't worry, this isn't about wrestling with complex accounting software or needing a finance degree. At its core, forecasting is just making an educated guess about the money coming in and going out over the next few months. This simple habit helps you see cash surpluses coming, and more importantly, spot potential shortfalls before they turn into full-blown crises.

Why a 13-Week Rolling Forecast is Your Go-To Tool

So, why 13 weeks? A quarter is the sweet spot. It's long enough to see real trends and give you time to make meaningful changes, but short enough that your predictions stay reasonably accurate. A 13-week rolling cash flow forecast is a dynamic document—you update it every week, so you always have a clear three-month window into your financial future.

To build it, you'll track three core components:

- Beginning Cash: The actual cash you have on hand at the start of each week.

- Cash Inflows: All the money you expect to receive, like payments from customers, loan funds, or any other income.

- Cash Outflows: All the payments you anticipate making, from payroll and rent to supplier bills and taxes.

Each week, you subtract the outflows from the inflows and add that number to your beginning cash. That gives you the projected ending cash for the week, which then becomes the starting point for the next one. Simple as that.

Forecasting in Action: An E-commerce Scenario

Let's make this real. Imagine you run an e-commerce store and the holiday season is on the horizon. Your forecast is about to become your crystal ball.

It’s early September, and you sit down to map out the next 13 weeks. You plug in your normal sales figures, but you also account for that reliable 40% sales bump you always get between November and December. Instantly, the forecast flags a major cash dip coming in October. The reason? You have to pay for a huge inventory order to stock up for the holiday rush, but the revenue from those sales won't actually land in your bank account until mid-November.

A cash flow forecast transforms uncertainty into a solvable problem. It shows you not just that a cash gap is coming, but exactly when and how big it will be, giving you precious time to act.

This kind of insight is a game-changer. Instead of being blindsided and scrambling for cash in October, you now have a six-week heads-up. You can confidently talk to a lender like FSE about a short-term working capital loan because you know exactly how much you need and have a clear projection showing when you can pay it back. You're making a smart, data-driven decision, not a desperate one.

This forward-looking view is what separates stable businesses from struggling ones. With 29% of business owners still wrestling with cash flow, forecasting gives you a massive advantage in timing your investments and heading off trouble. You can get a deeper look at how forecasting helps companies grow by checking out the latest cash flow trends at NotionCFO.com. Making this a weekly habit is how you stop driving your business by looking in the rearview mirror and start steering it toward predictable, sustainable growth.

Using Strategic Financing to Bridge Cash Gaps

Let's be clear: even the best-run businesses hit cash flow gaps. It’s a normal part of the cycle. You might see seasonal dips, a can’t-miss growth opportunity, or a big, unexpected expense that throws your projections off. This is where strategic financing stops being a last-resort and becomes a smart tool for keeping your momentum.

Think of financing as a bridge. It’s not a new foundation for your business; it's the structure you build to get from a temporary cash crunch to a position of strength. Tapping into external capital isn't a sign you're failing—it shows you’re a savvy operator who thinks ahead.

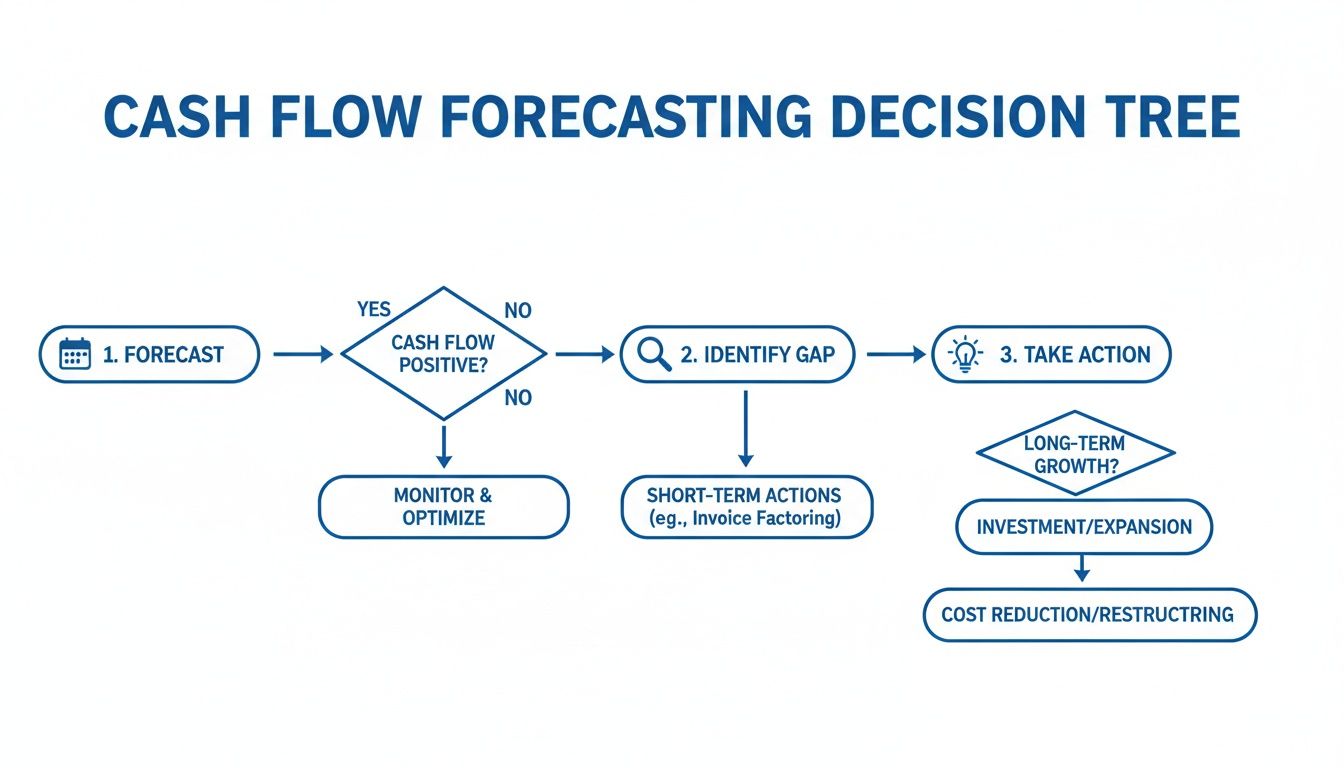

This entire process, from forecasting a potential gap to taking decisive action, is really the heart of strong financial management.

As you can see, a solid forecast gives you the runway to spot a potential shortfall and choose the right financial tool for the job—long before it becomes a crisis.

Matching the Funding to the Need

Not all financing is created equal. The trick is to match the funding product to the specific challenge you're solving. Grabbing the wrong tool for the job can be an expensive mistake.

Here are a few common scenarios I see all the time and the type of financing that makes the most sense:

- Covering Payroll During a Slow Season: A business line of credit is your best friend here. You draw funds when you need them to make payroll and pay the line down as sales pick back up. The beauty is you only pay interest on the amount you actually use.

- Jumping on a Bulk Inventory Discount: A short-term working capital loan provides a lump sum to snag that deal, letting you profit from the lower cost. You then pay back the loan as you sell through that new inventory.

- Investing in Equipment to Win a Big Contract: Equipment financing is designed for exactly this. The loan is secured by the asset itself, which often means better terms, and it lets you get your hands on revenue-generating machinery right away.

Strategic financing isn’t about borrowing to stay afloat. It’s about investing in activities that will generate more cash than the capital costs.

In a tight economy, these options become absolutely critical, especially when traditional banks are tightening their belts. Lender partnerships become a lifeline, unlocking the capital businesses need to manage volatility. Cash buffers are getting dangerously thin—only 25% of businesses now hold at least one month's revenue in their checking account, a sharp drop from 41% just a year ago.

For companies in construction, hospitality, or logistics, this is where alternative funders like FSE step in. By working with a network of over 50 partners, we can get financing approved in as little as 24-48 hours. You can get more details on what's happening in the 2025 cash flow landscape at EisnerAmper.com.

Knowing When to Pull the Trigger

So, how do you know when it’s the right time to seek capital?

The clearest signal is when you’ve identified a specific, time-sensitive growth opportunity that your cash on hand can’t cover. The worst thing you can do is wait until you're desperate. That’s when you have few options and make bad deals. By planning ahead, you can secure the right financing on the best possible terms, turning a potential cash gap into a genuine strategic advantage.

Answering Your Top Cash Flow Questions

Once we get past the theory, the questions I hear from business owners are always very practical. They're about what to do right now. Let's tackle some of the most common ones I get, reinforcing the strategies we've discussed with some clear, direct answers.

If you need to improve your cash position fast, the biggest and quickest wins are almost always hiding in your invoicing and collections. It sounds simple, but you have to stop waiting to send invoices. The second a job is done or a product is out the door, that invoice should be sent. Your entire goal is to close the gap between doing the work and having the money in your account.

At the same time, consider offering a small discount—even just 2%—for paying early. You'd be surprised how many clients will jump at the chance to save a little money, and it can slash your collection times. Pair this with a quick but ruthless review of your variable expenses. If it's not essential for operations or making you money, cut it for now.

How Often Should I Really Be Looking at My Cash Flow?

For most businesses I work with, a weekly review is the sweet spot. This isn't a deep dive; it's a quick, high-level glance at your rolling cash flow forecast. Doing this consistently lets you spot a potential shortfall weeks away, giving you plenty of runway to adjust course instead of panicking at the last minute.

Beyond that weekly pulse check, you need to sit down for a more detailed analysis of your cash flow statement once a month. This is where you connect the dots, understand the bigger trends, and see if the changes you've made are actually working. It’s also how you’ll get better and better at forecasting.

I tell my clients to think of it this way: the weekly review is like checking your GPS for traffic jams just ahead. The monthly analysis is like zooming out to look at the whole map, making sure you're still on the best route to your destination.

What Do I Do if a Bank Turned Me Down for a Loan?

Getting a "no" from a traditional bank feels like a major setback, but I can tell you from experience, it’s incredibly common and definitely not the end of the road. Banks have very strict, often outdated, lending criteria that a lot of perfectly healthy and growing businesses just don't fit into. This is exactly why the alternative financing market exists.

You have a ton of other options specifically built for this situation, like working capital loans, business lines of credit, or even a merchant cash advance. These products are a different breed.

- They almost always have more flexible qualification standards that look at the real health of your business, not just a single credit score.

- The funding process is dramatically faster—we're often talking 24 to 48 hours, not weeks or months.

- Their repayment structures are often designed to work with your cash flow cycles, not against them.

These alternatives are built to provide the capital you need to bridge a gap, jump on an opportunity, or just manage day-to-day costs when the bank can’t help.

If you’re feeling the pressure of a cash crunch or have been turned down by your bank, FSE - Funding Solution Experts is here to help. We work with a network of over 50 lenders who specialize in finding the right fit for unique business situations, with funding often secured in as little as 24 hours. Explore your funding options with no obligation.