Let's get one thing straight right away: a merchant cash advance (MCA) isn't a loan. It's something else entirely. Think of it as selling a small slice of your future sales at a discount to get cash in your hand right now.

This makes it a popular option for businesses that see a lot of credit card transactions—think bustling coffee shops, local retail stores, or even a growing e-commerce site. Instead of a rigid monthly payment, you repay a tiny, agreed-upon percentage of your daily sales. This built-in flexibility is its defining feature.

Understanding the Merchant Cash Advance

At its heart, an MCA gives you a lump sum of cash upfront. In exchange, the provider buys a portion of your business's future revenue. This is a fundamental departure from a traditional loan, where you're simply borrowing money and paying it back with interest over a fixed period.

With an MCA, the provider gets paid back automatically. They take a small percentage of your daily credit and debit card sales directly, and this continues until the advance is fully settled. It’s a hands-off process for you.

This model has become a real lifeline for small and mid-sized businesses, especially those that need cash fast or might not qualify for a bank loan. The MCA market has exploded in recent years, growing from about $8 billion in 2016 to over $19 billion by 2021. This surge is fueled by entrepreneurs in retail, restaurants, and online businesses who need quick, accessible capital. You can explore more about this industry growth and see how it helps businesses get ahead.

Key Differences from Traditional Loans

To really grasp what an MCA is, it’s helpful to put it side-by-side with a standard business loan. The biggest difference is the legal structure and how you pay it back. An MCA is classified as a commercial transaction—the sale of a future asset—not a loan or a debt.

This isn't just a technicality; it has real-world consequences for your business:

- Repayment Flexibility: Your payments rise and fall with your daily sales. Have a slow Tuesday? You pay less. A blockbuster Saturday? You pay a bit more. This dynamic helps protect your cash flow when business is unpredictable.

- Approval Criteria: MCA providers are far more interested in the health and consistency of your daily sales than your personal credit score. This opens the door for many business owners who might get turned down by a bank.

- Speed of Funding: This is where MCAs truly shine. Approval and funding can happen in as little as 24 hours. A traditional bank loan, on the other hand, can easily take weeks or even months.

To make this crystal clear, here’s a simple table that breaks down the core distinctions.

Merchant Cash Advance vs. Traditional Bank Loan at a Glance

This table provides a quick comparison of the fundamental differences between a Merchant Cash Advance and a standard business loan.

| Feature | Merchant Cash Advance (MCA) | Traditional Bank Loan |

|---|---|---|

| Structure | Sale of future receivables | Debt |

| Repayment | Percentage of daily sales | Fixed monthly payments |

| Approval Basis | Sales history and volume | Credit score, financials, collateral |

| Funding Speed | As fast as 24 hours | Weeks to months |

| Regulation | Not federally regulated as a loan | Heavily regulated (e.g., TILA) |

| Cost Structure | Factor rate (e.g., 1.2 - 1.5) | Annual Percentage Rate (APR) |

As you can see, they are two very different financial tools designed for different situations. While a loan offers structure and potentially lower costs over the long term, an MCA provides unmatched speed and flexibility.

How Merchant Cash Advance Repayment Works

To really get a handle on a merchant cash advance, you have to understand that its repayment process is nothing like a traditional loan. Instead of a rigid, fixed monthly payment, an MCA is built to ebb and flow with your daily sales. The whole system is surprisingly simple, built on just three core components.

Everything about your advance hinges on these key numbers:

- The Advance Amount: This is the lump-sum cash you get in your bank account upfront.

- The Factor Rate: Think of this as a simple multiplier, like 1.3, that determines your total payback amount. It’s important to remember this is not an interest rate.

- The Holdback Percentage: This is the small slice of your daily sales that the provider collects to pay back the advance.

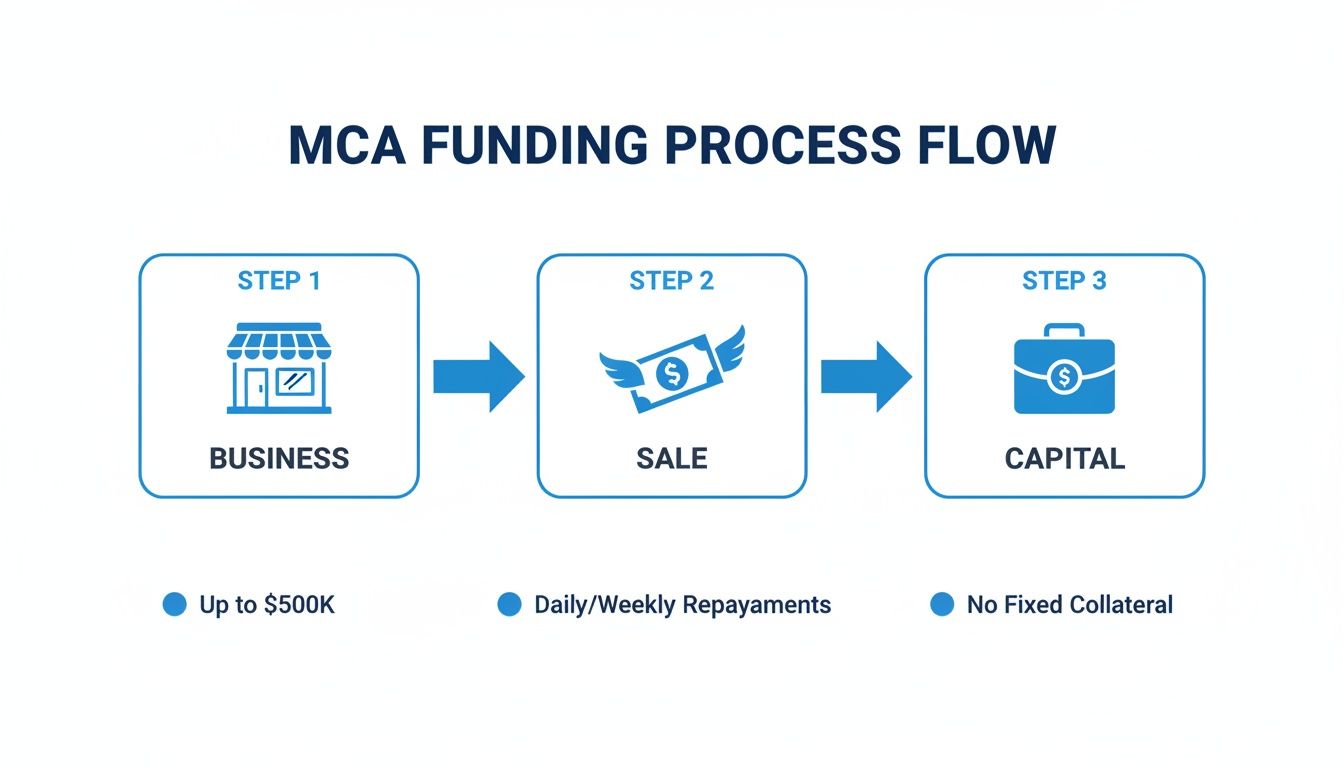

This quick diagram lays out the funding and repayment cycle.

As you can see, it's a continuous loop. Your daily sales are what directly fuel the repayment of the capital you received.

A Real-World Repayment Scenario

Let's put this into practice. Imagine you run a bustling local restaurant and desperately need $20,000 for a new commercial oven. An MCA provider offers you the funds with a factor rate of 1.3 and a holdback of 15%.

Here’s how that breaks down:

- Total to Repay: First, you calculate the total amount you’ll pay back. It's simply $20,000 (your advance) multiplied by the 1.3 factor rate, which comes out to $26,000.

- Daily Holdback: From that point on, 15% of your daily credit and debit card sales are automatically sent to the provider.

- Flexible Payments: This is where it gets interesting. On a fantastic Friday night, you might pull in $2,500 in sales, so your payment for that day is $375. But on a quiet Monday with only $800 in sales, your payment is just $120.

This process continues automatically until the full $26,000 is paid off. There are no fixed payment dates or amounts, which means the funding doesn’t become a burden when business inevitably slows down.

You can think of a merchant cash advance like a partnership. The provider gets paid when you get paid, taking a small piece of the pie only when you're making sales. It's this shared interest in your success that makes it such a useful tool for businesses with fluctuating revenue.

How Holdbacks Are Collected

There are two primary ways the daily holdback is actually collected, and your contract will specify which method is used.

The most seamless approach is an automated split-withholding that happens right at the source: your credit card processor. Your processor automatically carves out the agreed-upon holdback percentage from each day's batch, sending it to the MCA provider and depositing the remainder into your business bank account. You don't have to do a thing.

The other method is a fixed daily ACH withdrawal. With this setup, the provider analyzes your past sales history to estimate an average daily payment and then pulls that fixed amount from your bank account every business day. Most reputable providers using this model offer a reconciliation process, allowing you to adjust the payment if your sales take a significant dip.

This inherent flexibility is a huge reason MCAs have such high approval rates. In fact, a Federal Reserve study from 2020 noted an 84% approval rate. As you can see in these key industry statistics on Altline.com, this makes them a go-to option for businesses that don't have consistent, predictable revenue streams.

Calculating the True Cost of an MCA

One of the first things that trips people up when they're learning about merchant cash advances is the cost. It's not like a traditional loan with an Annual Percentage Rate (APR). Instead, MCAs use a much more direct pricing method called a factor rate.

Think of the factor rate as a simple multiplier. It’s a fixed number, usually somewhere between 1.2 and 1.5, that determines the total amount you’ll pay back. There’s no complex math, no compounding interest, and no confusing amortization schedules. The cost is locked in and crystal clear right from the start.

A Simple Calculation Example

Let's walk through a real-world example to see just how straightforward this is. Say your business gets a $20,000 cash advance, and the provider offers a factor rate of 1.3.

To figure out what you'll owe in total, you just do one quick multiplication:

- Advance Amount: $20,000

- Factor Rate: 1.3

- Total Repayment Amount: $20,000 x 1.3 = $26,000

That's it. The cost of that capital is a flat $6,000. It doesn't matter if you pay it back in six months or ten months—the total you owe will always be exactly $26,000. This predictability is one of the main draws of an MCA, removing the guesswork that often comes with fluctuating interest rates. You know your full financial commitment before you sign a thing.

The factor rate provides a clear, upfront picture of your total cost. It's a simple multiplier that cuts through the complexity of interest calculations, allowing you to see the full financial commitment immediately.

Why Not Use APR?

So, why don't MCAs use APR? The simple answer is that they aren't technically loans. Since your payments are a percentage of your daily sales, there’s no fixed repayment timeline. An APR calculation, by definition, requires a set term to figure out the annualized cost.

Because the payback period for an MCA can speed up or slow down with the rhythm of your business, an APR would be pretty misleading. If your sales suddenly take off, you might pay back the advance in just four months, which would make the "effective" APR look sky-high. On the flip side, if sales slow and it takes a full year to repay, the APR would look much lower.

The factor rate cuts through all that noise. It focuses on the one thing that doesn't change: the total, fixed cost of the funds, no matter how fast you repay it. This gives business owners a solid number to work with.

Weighing the Pros and Cons of an MCA

A merchant cash advance can be a powerful tool in the right situation, but let's be clear: it's not a silver bullet for every business's financial needs. It fills a very specific niche, offering some serious upsides that come with equally serious trade-offs. The only way to know if an MCA is the right move for you is to look at both sides of the coin, honestly and critically.

On the one hand, the benefits can feel like a lifesaver, especially for small business owners who are constantly juggling competing priorities. When you need cash now, an MCA is tough to beat.

The Advantages of a Merchant Cash Advance

The main draw of a merchant cash advance really boils down to two things: speed and accessibility. For businesses that need to move fast, these benefits can be worth their weight in gold.

Incredible Speed: This is probably the biggest selling point. A traditional bank loan can drag on for weeks, sometimes months. With an MCA, you can often go from application to funded in as little as 24 hours. That kind of speed means you can jump on a time-sensitive opportunity, like a bulk inventory deal, or cover an emergency repair without skipping a beat.

High Approval Rates: MCA providers are more interested in your daily sales and the overall health of your business than they are in a perfect credit score. This simple shift in focus opens the door to funding for countless businesses that might get turned down by a bank due to a short credit history or a few past financial bumps.

Flexible Repayments: Here’s where an MCA really differs from a loan. Your payments flex with your sales. Because you're paying back a small percentage of each day's revenue, you'll naturally pay less when business is slow and more when it's booming. This built-in flexibility can be a huge relief, protecting your cash flow from the pressure of a fixed payment during a seasonal dip.

The Disadvantages to Consider

Of course, those benefits don’t come for free. It’s absolutely critical to understand the potential downsides before you sign on the dotted line.

The biggest drawback is the price. There's no way around it—an MCA is one of the more expensive ways to get business funding. That speed, convenience, and the higher risk the provider takes on all get baked into the cost. The factor rate might seem simple, but when you do the math, it almost always adds up to a higher total cost than the APR you'd find on a traditional loan. If you have the luxury of time, a slower, more conventional option will be cheaper.

A merchant cash advance trades lower cost for speed and flexibility. The key is determining whether the immediate opportunity or urgent need you're addressing will generate a return that justifies the higher expense.

Beyond the cost, the daily repayment structure can be a double-edged sword. While flexible, having a chunk of your revenue pulled from your account every single day requires a new level of cash flow management. If you're running on razor-thin margins, those constant debits can feel relentless and might make it tough to cover other essentials like payroll or rent. It’s a model that demands discipline and a very clear picture of your daily financial rhythm.

Is a Merchant Cash Advance the Right Move for Your Business?

Figuring out the right funding for your business is a lot like choosing the right tool for a job. You wouldn't use a sledgehammer to hang a picture, and the same logic applies here. A merchant cash advance is a very specific kind of tool—it can be a powerful accelerator in the right situation, but a risky choice in the wrong one.

Ultimately, whether an MCA is a good fit comes down to your immediate business needs and, just as importantly, your ability to handle daily repayments.

When an MCA Can Be a Lifesaver

Think of an MCA as a short-term booster rocket. It's designed to get you somewhere specific, and fast. The ideal scenarios for an MCA are those where you have a clear, quick path to a return on your investment. In these cases, the higher cost can be completely justified by the immediate financial gain or by avoiding a much bigger loss.

Here are a few classic examples:

- Jumping on a Golden Opportunity: Imagine your main supplier offers you a 40% discount on your best-selling product, but you have to buy a huge quantity and the offer expires in 48 hours. An MCA gets you the cash to lock in that deal. The extra profit you make from selling the discounted inventory will more than cover the cost of the advance.

- Handling an Unexpected Crisis: Your restaurant's walk-in freezer suddenly dies on a Tuesday night. Every hour it's down, you're losing thousands in spoiled food and turning away customers. An MCA can get you funds overnight for the repair, saving you from a much bigger financial hit.

- Bridging a Predictable Cash Flow Gap: You run a seasonal business, like a landscaping company. You're flush with cash in the summer but slow in the winter, yet you need to order supplies in February to be ready for the spring rush. An MCA can bridge that gap, ensuring you're stocked and ready to go when business picks up.

When You Should Probably Look Elsewhere

On the flip side, an MCA is the wrong tool for long-term projects or businesses with unpredictable sales. Trying to use it for the wrong purpose is a surefire way to put a serious strain on your cash flow.

If you're looking to fund a year-long expansion, hire permanent staff, or cover chronic cash shortfalls in a business with wildly inconsistent revenue, an MCA is almost certainly not your answer.

An MCA is a tactical tool, not a long-term strategy. It's built for solving immediate problems or capturing fleeting opportunities, not for financing the fundamental, slow-and-steady growth of your company.

The MCA market is growing fast—it's projected to hit $25.38 billion by 2029. This growth is largely fueled by businesses in retail and e-commerce that have consistent credit card sales and often face the exact kinds of situations we just talked about. If you're interested in the numbers, you can dive deeper into the market's expansion in this detailed industry report. This trend really underscores just how valuable an MCA can be for the right business at the right time.

How a Funding Partner Can Help You Navigate the MCA World

Trying to find the right business funding can feel like you're lost in the woods. The jargon is a nightmare, the offers are confusing, and it’s tough to know who you can actually trust. This is especially true with merchant cash advances. But you don't have to go it alone.

Think of a funding partner like FSE as your guide. We simplify the entire process, from the first application to getting the cash in your bank. Instead of spending your precious time filling out endless applications for one provider after another, you just complete one simple form with us. That’s it. We take it from there.

Your Advisor Becomes Your Advocate

Once you submit your application, one of our dedicated advisors gets to work. We immediately tap into our trusted network of over 50 pre-vetted lenders to find the strongest offers that actually make sense for your business. It saves you the headache of hunting down and vetting all those providers yourself.

From there, we act as your personal advocate and translator, laying out the best options in plain English. An expert partner helps you:

- Compare Offers Side-by-Side: We put everything on the table—factor rates, holdback percentages, and total repayment costs—so you can clearly see the real numbers behind each offer.

- Understand the Fine Print: No more guessing games. We walk you through every term and condition to make sure there are no hidden fees or nasty surprises waiting for you.

- Secure the Right Fit: Our only job is to see your business succeed. We make sure the funding you get, whether it's an MCA or something else entirely, is a perfect match for your goals.

An expert funding partner doesn't just find you an offer; they find you the right offer. They provide the clarity and confidence needed to make a sound financial decision, letting you focus on running your business.

At the end of the day, our mission is to give you the knowledge and options you need to move forward. We handle the heavy lifting so you can make a choice you feel good about and get back to what you do best—growing your business. This partnership ensures you get capital on terms that help your company, not hold it back.

Common Questions About Merchant Cash Advances

Even after you've got the basics down, it’s completely normal to have a few more questions about merchant cash advances. This isn't your typical financing product, and the way it differs from a standard loan often brings up some specific concerns for business owners. Let's tackle some of the most common questions to clear things up.

What Are the Typical Eligibility Requirements?

This is one of the biggest differences between MCAs and bank loans. While banks dig deep into personal credit scores and demand years of financial documents, MCA providers are looking at something else entirely. Their primary focus is the strength and consistency of your daily sales.

While the exact criteria can differ from one provider to the next, here’s what most are looking for:

- Minimum Time in Business: You'll generally need to be up and running for at least one year.

- Monthly Revenue: A common benchmark is $10,000 or more in monthly sales.

- Consistent Sales Volume: They need to see a reliable flow of credit and debit card sales, because that’s how they get paid back.

Since approval hinges on your business's real-time performance, not your personal credit history, MCAs can be a lifeline for owners who might not get a second look from a traditional bank.

Does Getting a Merchant Cash Advance Affect My Credit Score?

This is a great question, and the answer has two sides. When you apply for an MCA, it typically does not affect your personal credit score. Most providers do what’s called a “soft pull,” which is a high-level check that doesn't get reported to other lenders. This is a huge plus compared to many loans that trigger a “hard inquiry” and can knock points off your score.

The important thing to remember, though, is what happens if you don't hold up your end of the deal. If you default on the agreement, the provider might pursue legal action, and that judgment could absolutely end up on your credit report. But the application process itself? It's usually designed to have zero impact on your credit.

At its core, a merchant cash advance is a sale of future receivables, not a loan. This crucial legal distinction is why it doesn't follow the same rules as traditional debt, which changes everything from credit reporting to regulation.

Can I Get an MCA If I Already Have a Business Loan?

Yes, you often can. Since an MCA isn’t classified as a loan, it usually doesn't conflict with clauses in an existing loan agreement that might prevent you from taking on more debt. MCA providers are mainly interested in your daily sales, not necessarily your other debt obligations.

Juggling both an MCA and a loan can be a strategic way to handle different financial needs. You might use the loan for a long-term expansion project and the MCA to jump on a short-term inventory opportunity. The key is to be brutally honest with yourself: can your daily cash flow truly support both payments? Stretching your business too thin is a serious risk that you have to manage carefully.

Finding the right business funding can feel overwhelming, but you don't have to go it alone. The team at FSE - Funding Solution Experts is here to help you weigh your options, make sense of the terms, and secure the right capital for your company’s next move. Apply in minutes and get a dedicated advisor today!