Revenue-based financing is a unique way to fund your business where you get cash upfront in exchange for a small slice of your future monthly revenues.Revenue-based financing is a unique way to fund your business where you get cash upfront in exchange for a small slice of your future monthly revenues. It's not a traditional loan with a rigid, fixed payment schedule. Instead, your payments ebb and flow with your sales—when revenue is strong, you pay back a bit more, and when things slow down, your payment shrinks to match.

A Flexible Partnership for Business Growth

Think of it this way. A traditional bank loan is like renting a piece of heavy machinery for your farm. You owe the rental company the same fixed fee every single month, whether you have a booming harvest or a drought. That can put a serious squeeze on your cash flow during lean times.

Revenue-based financing, or RBF, works differently. It’s more like a partner who invests in a state-of-the-art irrigation system for your farm. Instead of a fixed fee, they take a small, agreed-upon percentage of your crop each harvest. When you have a massive yield, they get a slightly larger share, and you pay off the investment faster. But if a season is slow, their share is smaller, which gives you the breathing room you need.

Key Features of the RBF Model

This whole model is built on a simple but powerful idea: the funder's success is tied directly to yours. They only get their money back quickly if your business is actually growing and making sales. That alignment is what makes RBF such a compelling option, especially for businesses with seasonal or fluctuating revenue.

Here’s a quick look at what defines the RBF model.

| Feature | Description |

|---|---|

| Funding Amount | Typically ranges from $10,000 to $10 million, based on your recurring revenue. |

| Repayment Structure | A fixed percentage of your monthly gross revenue, usually between 2% and 10%. |

| Total Cost | A predetermined "repayment cap," which is a multiple of the initial funding (1.1x to 2.5x). |

| Repayment Term | No fixed term; it ends once the total repayment cap is reached. |

| Collateral | Generally unsecured, with no personal guarantees required. |

| Equity Dilution | None. You keep 100% of your company ownership. |

What this table really shows is a system designed for flexibility and shared goals, moving away from the rigid constraints of old-school lending.

Let's break down the most important characteristics:

- Non-Dilutive Capital: This is a big one. You get the cash you need to grow without giving up any ownership or control of your company. Your equity is still your equity.

- Flexible Repayments: Payments are directly linked to your top-line revenue. This creates a natural financial cushion when you need it most.

- No Personal Guarantees: Most RBF providers don't ask you to pledge your house or personal assets as collateral, which dramatically reduces the personal risk for founders.

- Predictable Total Cost: You know exactly how much you'll pay back from day one. It's a simple multiple of the funding amount, known as the "cap," so you never have to worry about compounding interest or hidden fees.

RBF has quickly moved from a niche funding product to a major player in the small business world. The global market was valued at $6.4 billion in 2023 and is on track to explode to $178.3 billion by 2033. This isn't just a trend; it's a fundamental shift in how modern businesses think about raising capital. You can dig into the numbers yourself with the latest Allied Market Research findings.

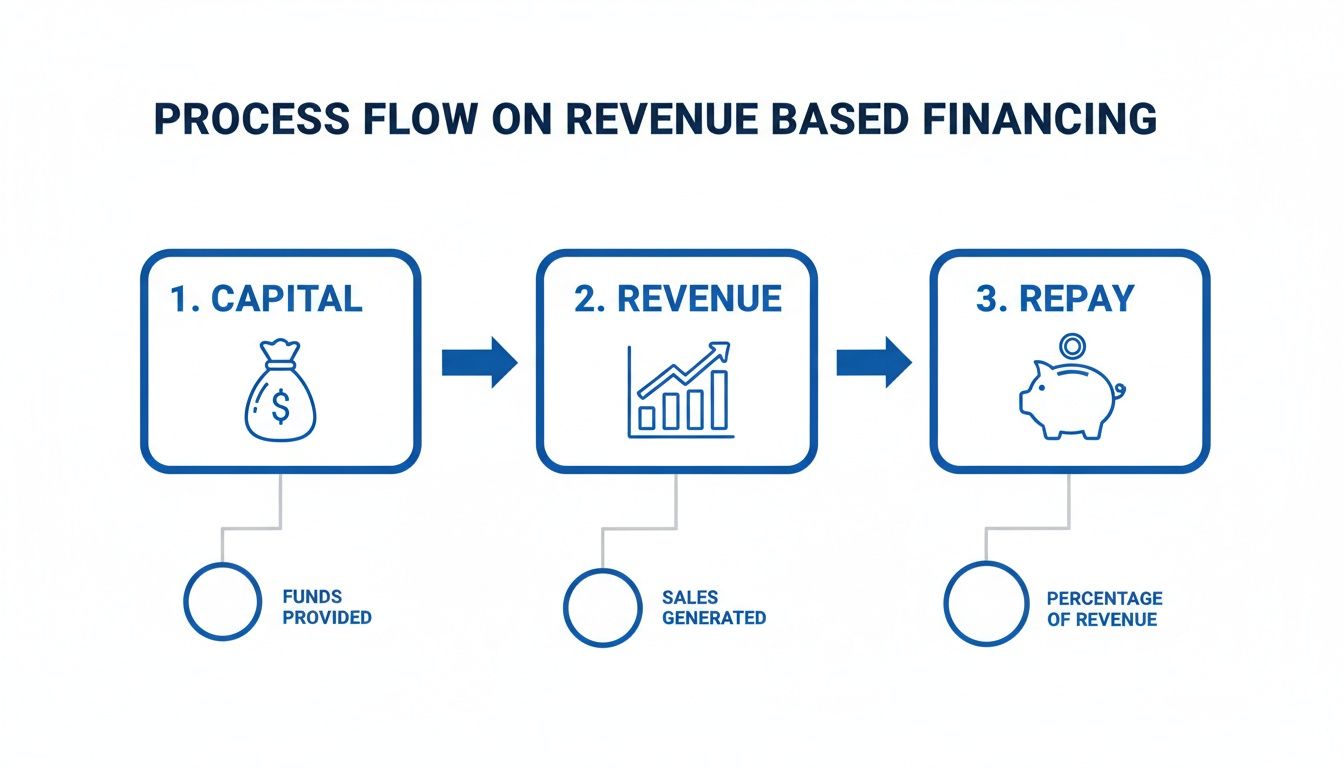

How a Revenue-Based Financing Deal Actually Works

Theory is one thing, but let's walk through how this plays out in the real world.

Imagine you run an e-commerce store selling handmade leather goods. Business is good, pulling in a steady $50,000 a month. But you’ve hit a ceiling and you know a targeted ad campaign could be a game-changer. The only problem? You need $100,000 to do it right.

This is a classic scenario for an RBF provider. They'll look at your sales history, see the potential, and offer you that $100,000 in growth capital. Instead of a loan with interest rates and rigid payment schedules, the deal hinges on three straightforward numbers.

The Three Pillars of an RBF Agreement

Forget the confusing jargon of traditional finance. Every revenue-based financing deal boils down to these three key components.

- Upfront Capital: This is the cash you get wired to your account. In our example, it’s $100,000.

- Repayment Cap: This is the total fixed amount you'll ever pay back. It's calculated by multiplying the capital by a simple rate (like 1.4x). For your $100,000, a 1.4x cap means you'll repay a grand total of $140,000. No more, no less.

- Revenue Share Percentage: This is the slice of your monthly revenue that goes toward paying down the cap. It's usually a small percentage, often somewhere between 2% and 10%. Let's say you agree to 8%.

This simple structure creates a cycle: the capital injection fuels growth, which increases revenue, and a small piece of that new revenue goes toward repayment.

Repayments That Flex with Your Business

Now for the best part. Let's see how this works month-to-month.

You launch your ad campaign, and it’s a hit. The very next month, your revenue jumps to $75,000. Your repayment for that month is simply 8% of $75,000, which comes out to $6,000. When business is booming, you pay down that $140,000 total faster.

But what about a slow month? Maybe two months later, sales dip to $40,000 during a seasonal lull. Your payment automatically adjusts with your cash flow.

Instead of scrambling to make a fixed payment you can't afford, your repayment drops to 8% of $40,000, which is just $3,200. This built-in flexibility is the signature feature of revenue-based financing. It’s a financial shock absorber that traditional loans just don't have, protecting your cash flow right when you need it most.

This dynamic means there’s no fixed term. You keep making payments based on your monthly sales until you hit the $140,000 cap. If you have an explosive year, you might pay it off in 12 months. If growth is a bit slower, maybe it takes 24 months.

Either way, the total cost never changes. That gives you incredible predictability and control over your finances.

Understanding the True Cost of RBF

Getting your head around the cost of revenue-based financing requires a slight shift in thinking. If you're used to traditional bank loans, you're probably looking for an Annual Percentage Rate (APR). You won't find one here.

Instead, the cost is wrapped up in a single, fixed fee known as the repayment cap. This is just a simple multiplier applied to your original funding amount, and it usually falls somewhere between 1.1x and 2.5x.

What this means is you get total clarity right from the start. You know the exact dollar amount you'll repay, period. There's no complex amortization schedule or compounding interest to worry about, which can often muddy the waters with traditional loans.

RBF vs. Traditional Loans: A Cost Comparison

Let's put some real numbers to this. Say your company needs $100,000 to fund a new marketing campaign.

- RBF Deal: The provider offers a 1.4x repayment cap. This means your total repayment is locked in at $140,000. The cost of that capital is a flat $40,000, regardless of whether it takes you six months or two years to pay it back.

- Traditional Loan: You get a $100,000 term loan. The total interest you pay—the real cost of the capital—hinges entirely on the interest rate and the repayment term, making the final figure less certain from the outset.

Sure, if you just compare the numbers on paper, the effective rate of an RBF deal can look more expensive than a bank loan's stated interest rate. But that's an apples-to-oranges comparison. It completely misses the point of why businesses choose RBF in the first place.

With RBF, you’re buying flexibility. You're paying for a partner who takes on risk alongside you. The provider only gets their return when you're making money. That alignment is a powerful safety net for your cash flow during a slow month—a feature a traditional loan simply can't offer.

A Market Growing on Smarter Data

This flexible approach is changing the game for how companies get funded. The RBF market was valued at around $9.77 billion in 2025 and is expected to rocket to $67.73 billion by 2029. This isn't just a fad; it's a boom fueled by better data analytics that enable faster and more precise risk assessments than old-school lenders can manage. You can dig into the numbers behind this explosive market growth to see for yourself.

At the end of the day, the "true cost" isn't just about the fee. It's about the value of having a financial partner who wins only when you do. You're paying for capital that ebbs and flows with your business, not against it.

How Does RBF Stack Up Against Other Funding Options?

Picking the right funding for your business is a make-or-break decision for any founder. To really get a feel for where revenue-based financing shines, you have to see how it compares to the more traditional options out there. Each one has its place, and what's right for you will come down to your company's stage, your goals, and your cash flow.

This isn't just about finding the cheapest capital; it's about finding the smartest capital for your situation. RBF carves out a unique niche, offering a blend of speed and flexibility that’s hard to come by. But it’s not a silver bullet for everyone.

Let’s dig into the key differences.

RBF vs. Traditional Term Loans

When most people think of business funding, the classic bank term loan is what comes to mind. It’s straightforward: you get a lump sum of cash and pay it back in fixed monthly installments, plus interest, over a set period.

The main draw here is the potentially lower interest rate, which can look very attractive on paper. The catch? Getting one is tough. The application process is notoriously slow and buried in paperwork, and banks typically demand a high credit score, personal guarantees, and sometimes even hard assets as collateral. Plus, if you have a slow month, that fixed payment is still due, which can put a serious squeeze on your cash flow.

RBF is a different animal. The funding process is much faster, and providers are more interested in your revenue track record than your personal credit score. The real game-changer is the flexible repayment model, which acts as a built-in shock absorber by tying your payments directly to your performance.

RBF vs. Venture Capital Equity Financing

Venture capital is the go-to for high-growth startups shooting for the moon. With VC funding, you’re not taking on debt; you’re trading a slice of your company—equity—for a significant cash injection.

The upside can be huge, giving you access to serious capital and the strategic guidance of experienced investors. But it comes at a steep price: you permanently give up a piece of your business and, often, a degree of control. This is what’s known as dilution.

Revenue-based financing is fundamentally non-dilutive. You keep 100% ownership and control of your business. Your RBF provider is a temporary financial partner, not a permanent shareholder. Once you’ve repaid the capital plus the fee, you’re done. All future profits are yours to keep.

RBF vs. Merchant Cash Advances

On the surface, a Merchant Cash Advance (MCA) can look a lot like RBF, but they operate very differently under the hood. An MCA provider essentially buys a chunk of your future credit card sales at a discount. They then repay themselves by taking a fixed percentage of your daily card transactions until the debt is settled.

This structure can be extremely aggressive. The daily repayment schedule can cripple your cash flow, and because the cost is calculated as a "factor rate" instead of an APR, the effective annual interest rates can be astronomical. MCAs are often seen as a last-resort option for a reason. While RBF also links payments to revenue, it typically uses a smaller monthly percentage, making it a far more sustainable and founder-friendly alternative.

To help you see these differences at a glance, we've put together a simple comparison.

Comparison of Business Financing Options

The table below breaks down the core features of these funding types, helping you see where each one fits into the broader landscape of business capital.

| Funding Type | Repayment Structure | Typical Cost | Collateral Required | Equity Dilution |

|---|---|---|---|---|

| Revenue Based Financing | Flexible percentage of monthly revenue | Fixed fee (repayment cap) | Generally none | None |

| Traditional Term Loan | Fixed monthly payments plus interest | Interest rate (APR) | Often requires personal guarantees and assets | None |

| Venture Capital | No direct repayment; return is via an exit | Ceding a large percentage of ownership | None | High |

| Merchant Cash Advance | Fixed percentage of daily credit card sales | High factor rate (often 1.2x to 1.5x) | Business assets, often with a personal guarantee | None |

Ultimately, the best choice hinges on your specific needs. Are you optimizing for cost, speed, flexibility, or control? Answering that question will point you toward the right financial partner for your journey.

Is Revenue-Based Financing Right for Your Business?

Choosing the right way to fund your business is a big decision, one that hinges on where you are right now and where you want to go. While revenue-based financing brings a ton of flexibility to the table, it’s certainly not a one-size-fits-all solution. Think of it less as a lifeline and more as rocket fuel.

The sweet spot for RBF is a business that’s already up and running and has a clear path to growth. This usually means you have a history of steady, predictable revenue. You don't need to be a huge company, but investors will want to see a solid track record of sales. Healthy gross margins are just as important—they signal you can handle the repayments without squeezing your day-to-day operations. Finally, you need a specific, well-defined plan for the money. Are you doubling down on a marketing channel that works? Stocking up for the holiday rush? This is what RBF is built for.

Prime Candidates for RBF

Some business models are practically tailor-made for RBF's flexible repayment style. They tend to have recurring revenue streams or predictable sales cycles, which makes them an ideal match for this kind of growth capital.

- SaaS and Subscription Businesses: Companies with predictable monthly recurring revenue (MRR) are a classic fit. RBF lets them pour money into customer acquisition without diluting their ownership.

- E-commerce and Retail Brands: These businesses can tap RBF to load up on inventory before a big sales season or to scale up digital ad campaigns with a proven return on investment.

- Professional Services and Agencies: Firms with clients on retainer or a steady flow of project work can use RBF to smooth out cash flow, bring on new talent, or invest in tech to serve clients better.

The data backs this up. North America was the leading market for RBF in 2023, with small and medium-sized enterprises (SMEs) driving the trend, accounting for over 78% of all deals. The retail and e-commerce sector was the single biggest user, which really highlights how well this model works for businesses with fluctuating income. You can dig into the numbers in the latest market report.

When to Consider Other Options

Knowing when to walk away from an RBF deal is just as crucial as knowing when to pursue one. Its structure is purpose-built for scaling, not for keeping the lights on or testing a brand-new idea.

You should probably look at other funding avenues if your business:

- Is Pre-Revenue: If you aren't making sales yet, you don't have a revenue stream to share. At this stage, you’re better off looking into venture capital or angel investors.

- Has Razor-Thin Margins: When your profit margins are already tight, the fixed fee from an RBF agreement could put a real strain on your finances, even with the flexible payment schedule.

- Lacks a Clear Growth Plan: RBF is expensive money if you're just using it to plug operational gaps. It delivers its best punch when tied directly to a specific plan to bring in more revenue.

How to Apply and Evaluate RBF Offers

Unlike a traditional bank loan application that can feel like an archaeological dig through your financial past, applying for revenue-based financing is a refreshingly modern experience. It’s built for speed.

The entire process is data-driven. Instead of focusing on your personal credit or years of tax returns, RBF providers care about one thing above all else: your recent business performance. They want to see consistent, healthy cash flow.

Most applications happen online, where you'll securely connect your business bank accounts, accounting software, and payment processors. This gives the provider a real-time window into your sales, allowing them to assess risk and make a funding decision in days, not weeks.

What You'll Need to Apply

Getting your ducks in a row beforehand will make the process even smoother. While every provider is a little different, you should be ready to share secure, read-only access to a few key platforms:

- Bank Statements: You'll typically need to connect accounts showing the last 6 to 12 months of business activity to prove revenue consistency.

- Accounting Software: Linking to tools like QuickBooks or Xero gives funders a clear picture of your overall financial health and profitability.

- Payment Processor Data: If you’re an e-commerce or SaaS company, this is essential. You’ll connect your Stripe, Shopify, or other payment gateway accounts.

With this data, the funder can run their underwriting models and quickly return a term sheet tailored to your business's specific performance.

Key Questions to Ask When Evaluating an Offer

Receiving an offer is just the start—now comes the most important part. It’s tempting to just look at the funding amount, but the real value (or risk) is buried in the details. You need to dig in and make sure the deal actually works for your business.

The best offer isn't always the biggest one. A slightly smaller funding amount with a lower revenue share percentage and a reasonable repayment cap is often a much healthier choice for your cash flow in the long run.

Don't sign anything until you have crystal-clear answers to these questions:

- What is the exact repayment cap? This is the total amount you will ever pay back. Get this number in writing.

- What is the revenue share percentage? How big of a slice will they take from your top line each month?

- How is "revenue" defined in the contract? This is a critical detail. Is it gross sales? Or is it net revenue after refunds and returns? The difference can have a massive impact on your monthly payment.

- Are there any other fees? Ask directly if there are any origination fees, platform fees, or other hidden costs baked into the agreement. A good partner will be transparent.

Common Questions About Revenue-Based Financing

As you dig into whether revenue-based financing makes sense for your business, a few questions almost always pop up. Let's tackle them head-on so you can make a smart, informed decision.

Is RBF Considered Debt on My Balance Sheet?

This is a big one, and it's a common point of confusion. The short answer is, typically, no.

Revenue-based financing isn't structured like a traditional loan. Instead, it's considered a purchase of future receivables. This distinction is key because it means the funding doesn't show up as debt on your balance sheet. For founders trying to maintain a clean financial profile for future funding rounds, this can be a major plus.

Do I Need to Provide a Personal Guarantee?

One of the most appealing aspects of RBF is that it lowers the personal risk for you, the founder. While you should always check the fine print, the vast majority of RBF agreements do not require a personal guarantee.

This means you aren't asked to put your personal assets—like your house or car—on the line for the business capital. It’s a huge departure from the old-school lending world.

A core idea behind RBF is shared risk. The investor is betting on your future success. If your revenue dips, your payments dip too. If sales grind to a halt for a month, your payment would likely drop to zero, giving you a level of protection you just don't get with traditional loans. Always confirm this specific term in your agreement.

Finally, business owners often wonder if they can pay the capital back early to save on costs. With a standard loan, paying it off sooner means you pay less in total interest. RBF works differently. The total payback amount is a fixed, agreed-upon multiple of the capital you received. Paying it off faster doesn't change that final number; you've bought the capital, not rented it over time.

Ready to explore flexible funding that actually grows with your business? The dedicated advisors at FSE - Funding Solution Experts can help you compare offers from over 50 lenders to find the perfect fit, with decisions in as little as 24 hours. See what you qualify for.