Working capital is, quite simply, the cash you have on hand to run your business day-to-day. It’s the money you use to pay your employees, buy inventory, and cover bills before you get paid by your customers. Think of it as the financial lifeblood that keeps your operations flowing smoothly between your outgoings and your income.

Understanding Working Capital: The Fuel for Your Business

It’s a common mistake for small business owners to think strong sales automatically equal a healthy bank account. In reality, it's rarely that simple. There’s often a painful delay between when you have to pay your own bills and when your clients actually pay you. That timing difference is the notorious cash flow gap, and it's one of the biggest hurdles any growing business has to clear.

Imagine a landscaping company that lands a big commercial contract. The owner has to pay for mulch, plants, fuel, and the crew’s wages right away. But what if the client's invoice terms are 30, 60, or even 90 days? All that cash is tied up, making it tough to cover other operating costs or even think about taking on another job. This is precisely where having enough working capital for small businesses is a game-changer.

Why Traditional Funding Falls Short

In the past, the go-to solution was a traditional bank loan or line of credit. But getting one of those has become a real challenge. Banks have tightened their standards, and they often want to see years of business history, perfect credit, and plenty of collateral before they’ll even talk. The whole process can be painfully slow, leaving perfectly good businesses high and dry.

This is a massive problem when you consider that 56% of small businesses are looking for funding just to cover basic operating expenses. When the bank says "no," or the approval drags on for weeks, you need a faster, more practical alternative.

Working capital isn't just about paying bills; it's about seizing opportunities. It’s the difference between barely surviving a slow season and having the resources to invest in a marketing campaign that drives future growth.

The Modern Solution for Cash Flow Gaps

Thankfully, the funding world has changed. Today, there are all sorts of flexible funding solutions designed specifically to help businesses close their cash flow gaps quickly. These options are built for owners who need capital now, without jumping through the impossible hoops of traditional banking.

When you manage your working capital effectively, you can:

- Meet Payroll on Time: Keep your team happy and paid consistently, which is huge for morale and retention.

- Purchase Inventory: Jump on bulk-order discounts or stock up ahead of your busy season.

- Cover Unexpected Expenses: Handle a sudden equipment repair without derailing your entire operation.

- Fund New Growth: Invest in that new project or marketing idea you know will expand your business.

Getting a handle on your working capital needs is the first real step toward financial stability and unlocking your company's potential. In the next sections, we’ll dig into how to calculate what you need and find the funding solution that fits your situation perfectly.

How To Calculate Your Working Capital Needs

Before you can fix a cash flow problem, you first have to get a handle on its size. Calculating your working capital isn't just a stuffy accounting exercise; it's a vital health check for your business. It gives you a clear, data-driven answer to the all-important question, "How much cash do I actually need to keep things running smoothly?"

The whole process starts by pulling two key numbers from your balance sheet: current assets and current liabilities. Just think of these as what you own and what you owe in the near future, typically over the next 12 months.

Understanding Current Assets and Liabilities

Current assets are all the resources your business can turn into cash relatively quickly. This is more than just the money sitting in your bank account; it’s also the cash that’s on its way to you.

- Cash and Cash Equivalents: This is the most straightforward part—the money in your checking and savings accounts, ready to be spent.

- Accounts Receivable (AR): This is all the money your customers owe you for jobs you've already completed or products you've delivered. Essentially, it's the value of your outstanding invoices.

- Inventory: This is the dollar value of everything you have on hand to sell, from raw materials and works-in-progress to finished goods sitting on the shelf.

On the flip side, you have your current liabilities. These are your short-term debts and financial obligations that are due within the next year.

- Accounts Payable (AP): This is the money you owe to your suppliers, vendors, and other partners for goods and services you've already received.

- Short-Term Debt: This bucket includes any loan payments, credit card balances, or lines of credit installments coming due in the next 12 months.

- Accrued Expenses: These are the bills you know are coming but haven't paid yet, like your next payroll run, rent, or utilities.

The Basic Working Capital Formula

Once you’ve gathered those figures, the math is simple. The formula gives you a dollar amount that represents your business's day-to-day financial firepower.

Working Capital = Current Assets - Current Liabilities

A positive number is a great sign—it means you have more short-term assets than debts. But a negative number signals a working capital deficit, which is a red flag for potential cash flow struggles down the road.

Let’s look at a real-world example. Imagine a trucking company with $20,000 in the bank, $50,000 in accounts receivable from completed deliveries, and $5,000 in spare parts (inventory). Their liabilities include $15,000 in accounts payable for fuel and $10,000 in upcoming truck loan payments.

Their calculation would look like this: ($20,000 + $50,000 + $5,000) - ($15,000 + $10,000) = $50,000 in working capital.

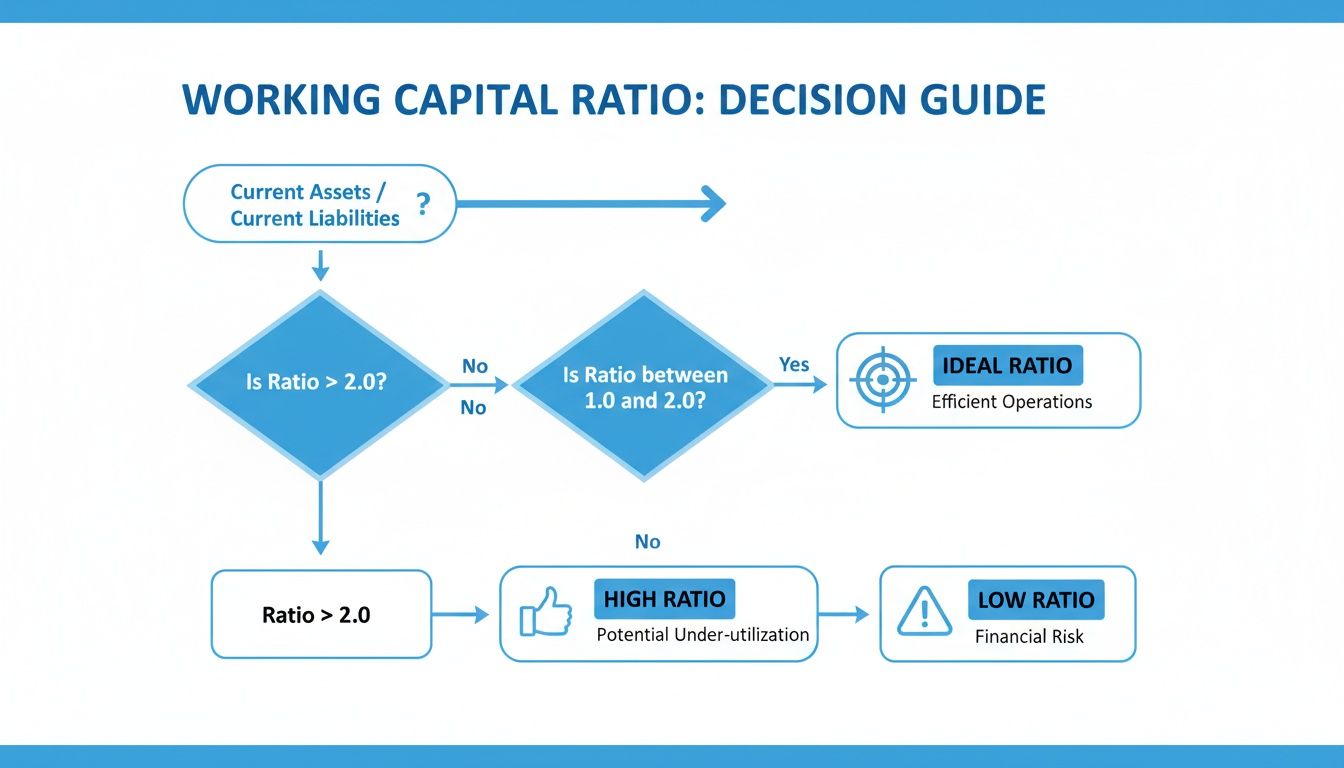

Going Deeper with the Working Capital Ratio

While that dollar amount is helpful, the working capital ratio gives you much deeper insight into your financial stability. It tells you exactly how many times you could pay off your short-term debts using only your short-term assets.

Working Capital Ratio = Current Assets / Current Liabilities

Using our trucking company example again: $75,000 / $25,000 = a ratio of 3.0

This ratio is a powerful metric for the health of your business. A ratio below 1.0 is a warning sign, suggesting you don’t have enough liquid assets to cover your immediate bills. Most lenders and financial experts like to see a ratio between 1.2 and 2.0, as it indicates a healthy, well-run operation. Anything too high, though, might mean you aren't putting your cash to work growing the business.

Interpreting Your Working Capital Ratio

This simple table can help you make sense of your own working capital ratio and what it says about your company's financial footing.

| Ratio Value | Operational Health | What It Indicates |

|---|---|---|

| Below 1.0 | High Risk | You may struggle to meet short-term obligations without additional funding. This signals a negative working capital position. |

| 1.2 to 2.0 | Healthy & Stable | You have sufficient assets to cover liabilities and are likely managing your cash flow effectively. This is the ideal range. |

| Above 2.0 | Potentially Inefficient | While financially secure, you may have too much cash tied up in inventory or uncollected invoices instead of investing it for growth. |

So, what does this look like in practice? Think about a retail store owner gearing up for the holiday rush. They might take on short-term debt to stock up on $100,000 in new inventory. While this boosts their assets, it also raises their liabilities. By calculating their working capital ratio before and after this move, they can make sure they’ll still have plenty of breathing room to cover all their bills during their busiest season.

Knowing these numbers isn't about passing an accounting test—it's about mastering your company's financial rhythm.

Finding the Right Funding for Working Capital

Once you realize you have a working capital gap, the next question is obvious: where do you get the cash to fill it? For a lot of small business owners, walking into a traditional bank for a loan feels like hitting a brick wall. This isn't just a feeling; it's a widespread reality.

Traditional banks have been tightening their lending standards for 13 consecutive quarters, creating a major funding gap for small businesses across the U.S. In fact, a staggering 56% of small businesses are looking for funds right now just to cover the basics like payroll and rent. For businesses in fast-moving industries like construction or trucking, waiting weeks for a "yes" or "no" from a bank just doesn't work. This is where alternative funders, who can provide a decision in 24 hours and funding in 24-48 hours, become absolutely essential. You can dig deeper into these trends in recent industry reports on small business lending.

Thankfully, a whole world of fast, flexible funding solutions has opened up, each built to solve specific cash flow headaches. Let's walk through the most common options.

Business Line of Credit

Think of a business line of credit as a safety-net credit card for your company. You get approved for a certain amount of capital, and you can draw from it whenever you need it, for whatever you need. You only pay interest on the money you actually use, and once you pay it back, the full credit line is available to you again.

This kind of flexibility is a game-changer for managing the natural, often unpredictable, rhythm of a business.

- Best For: A restaurant owner could use their line of credit to make payroll during a slow winter, then tap into it again to stock up on inventory for a big summer festival.

- Key Benefit: You have a standing financial backstop without the hassle of reapplying every time a need pops up.

- Funding Speed: After you're approved, you can typically access your funds within 1-2 business days.

A line of credit is perfect for handling those recurring, unpredictable expenses, rather than a single, massive purchase. It offers peace of mind, knowing you have capital ready to go at a moment's notice.

Invoice Financing

Also known as accounts receivable financing, invoice financing lets you turn your unpaid invoices into immediate cash. Instead of biting your nails for 30, 60, or even 90 days waiting for a client to pay, you can get an advance—often up to 85% or more of the invoice value—right away.

The process is simple: the financing company advances you the cash and then collects the payment from your customer. Once the invoice is paid in full, they send you the remaining balance, minus their fee.

- Best For: A construction contractor finishes a big project and sends out a $50,000 invoice with 60-day terms. Instead of waiting, they use invoice financing to get $42,500 upfront, letting them pay their crew and buy materials for the next job without missing a beat.

- Key Benefit: It directly closes the cash flow gap created by slow-paying customers, unlocking the money you've already earned.

- Funding Speed: You can often get funded within 24-48 hours after your invoices are verified.

This is a lifeline for B2B companies that are profitable on paper but constantly squeezed by long payment cycles.

This flowchart can help you see how your working capital ratio points you toward the right financial strategy.

As you can see, a low ratio is a clear signal that you need funding, an ideal ratio means you're positioned for growth, and a high ratio suggests it’s time to put your idle cash to work.

Merchant Cash Advance

A Merchant Cash Advance (MCA) isn't a loan in the traditional sense. Instead, it's an advance on your future sales. A funder gives you a lump sum of cash in exchange for a small percentage of your daily credit and debit card sales, which continues until the advance is fully paid back.

The beauty of an MCA is that repayment flexes with your sales. When business is booming, you pay back more; when things are slow, you pay back less.

- Best For: An e-commerce store needs $25,000 to load up on inventory before Black Friday. They use an MCA to get the cash fast, and the advance is repaid automatically from a fraction of each sale during their busiest season.

- Key Benefit: Your sales history matters more than your credit score for approval, and the repayment model is incredibly flexible.

- Funding Speed: MCAs are built for speed, with funding often hitting your account in as little as 24 hours.

This makes an MCA a great option for businesses in retail, restaurants, and e-commerce that have strong sales but might not qualify for other types of financing.

Short-Term Loans

A short-term loan gives you a single lump sum of cash that you repay over a fixed schedule, usually from three months to two years. Unlike their traditional bank counterparts, these loans are designed for speed and accessibility, with much simpler applications and quicker funding times.

They are best used to finance a specific, immediate need that will help you generate more revenue.

A short-term loan is a strategic tool, not just a bandage. It’s best used to fund an opportunity—like a bulk inventory purchase or a marketing campaign—that will directly boost your revenue and allow you to comfortably manage the fixed repayment schedule.

- Best For: A home services company takes out a short-term loan to buy a new, more efficient piece of equipment, enabling them to complete more jobs each week.

- Key Benefit: You get a predictable repayment plan and a one-time infusion of cash for a targeted purpose.

- Funding Speed: Funding is often available within 1-3 business days.

To help you decide, here's a quick comparison of the options we've covered.

Comparing Working Capital Funding Options

| Funding Type | Best For | Funding Speed | Key Benefit |

|---|---|---|---|

| Business Line of Credit | Ongoing, unpredictable expenses and managing cash flow ups and downs. | 1-2 Business Days | Revolving access to capital; only pay interest on what you use. |

| Invoice Financing | B2B businesses with slow-paying customers who need to unlock cash from invoices. | 24-48 Hours | Solves cash flow gaps caused by long payment cycles. |

| Merchant Cash Advance | Businesses with high credit card sales (retail, restaurants) needing fast cash. | 24 Hours | Flexible repayment tied to daily sales; less credit-dependent. |

| Short-Term Loan | A specific, one-time investment or opportunity with a clear ROI. | 1-3 Business Days | Lump sum of cash with a predictable, fixed repayment schedule. |

Ultimately, picking the right working capital solution comes down to your unique situation—what's causing your cash flow crunch, how quickly you need the funds, and how your business operates day-to-day.

Actionable Steps to Improve Your Cash Flow

While finding the right funding can be a lifesaver for bridging a cash flow gap, the real power lies in proactive financial management. By taking control of your daily operations, you can lessen your dependence on outside capital and, when you do need a loan, you'll be a much stronger applicant.

Think of it this way: these strategies aren't just good business habits. They are hands-on moves that directly impact the numbers in your working capital calculation. Better cash flow means you can pay down debts faster, grow your assets, and build a more resilient company from the ground up.

Accelerate Your Accounts Receivable

For most small businesses, the money tied up in unpaid invoices is a massive, often overlooked, asset. The quicker you turn those invoices into actual cash, the healthier your working capital will be. The key metric to watch here is your Days Sales Outstanding (DSO)—the average time it takes to get paid after a sale.

A high DSO means your cash is sitting in your clients’ bank accounts, not yours. Here are a few proven ways to speed things up:

- Offer Early Payment Discounts: This is a classic for a reason. Giving a small incentive, like 2% off for paying an invoice in 10 days instead of the usual 30 (often written as "2/10, net 30"), can work wonders for your cash inflows.

- Sharpen Your Invoicing Process: Don’t wait. Send invoices the moment a job is done or a product is delivered. Make sure they’re crystal clear, professional, and offer multiple ways to pay, like an online portal or ACH transfer.

- Create a Follow-Up System: Be persistent but professional. Set up automated reminders that trigger before an invoice is due, and have a clear, consistent process for chasing down late payments.

When you tighten up your collections, you directly pump up the "Current Assets" side of your working capital formula, putting more cash at your disposal.

Optimize Your Inventory Management

If you sell physical products, your inventory is a huge cash investment just sitting on shelves. You obviously need enough stock to keep customers happy, but every extra box is frozen cash that also racks up costs for storage, insurance, and potential obsolescence.

Smart inventory management is all about balance. It’s not just about cutting stock—it's about perfectly aligning what you have with what your customers actually want, freeing up money that would otherwise be gathering dust.

Try these tactics to get your inventory working for you, not against you:

- Adopt a Just-in-Time (JIT) Mindset: Whenever possible, order materials and products only as you need them for production or sales. This stops you from tying up precious capital in goods that aren't sold yet.

- Dive Into Your Sales Data: Figure out what’s flying off the shelves and what’s not. Run a sale or discount slow-moving products to turn that dead stock back into cash.

- Build Better Supplier Relationships: Talk to your suppliers. Can they offer faster shipping or smaller minimum orders? Being able to restock more frequently in smaller batches prevents you from having to make huge, cash-draining purchases.

Cutting down on excess inventory lowers your carrying costs and turns a static asset into real, usable cash.

Strategically Manage Your Accounts Payable

You want to get paid fast, but when it comes to paying your own bills, a little strategy goes a long way. This doesn't mean paying late—that’s a quick way to ruin your credit and burn bridges with suppliers. It’s about using the payment terms you’re given as a tool.

If a vendor gives you 30-day terms, use the full 30 days. Paying that invoice on day one when you have a month is like giving away an interest-free loan. Your cash leaves your account sooner than it has to, which can put a squeeze on your short-term liquidity.

Don't be afraid to negotiate, either. Ask your long-standing suppliers for better terms, like net 45 or net 60. Even an extra 15 to 30 days can give you incredible breathing room, letting you use your cash to run the business before it goes out the door.

How to Secure Fast Capital for Your Business

Navigating the world of small business financing can feel overwhelming, especially when traditional banks move at a glacial pace or just say no. For many owners, the challenge isn’t just finding funding—it’s finding it fast enough to solve a problem right now or jump on a great opportunity.

When you need working capital for your small business, waiting weeks for a decision simply isn't an option.

The good news is that the funding process has changed. By working with a commercial finance brokerage, you can bypass the lengthy paperwork and strict requirements that often come with conventional lenders. Instead of applying to one bank at a time, you fill out a single, simple application that connects you to a network of over 50 specialized funding partners, all competing to work with you.

A Faster Path to Funding

This whole approach is designed to turn a potential "bank no" into a "funded fast" decision. It's a common story: while business owners are optimistic about the future, getting access to capital remains a huge roadblock. For instance, many firms (68%) are looking to adopt AI for efficiency, but 42% simply lack the resources to implement new technologies, creating a cash crunch.

You can dig into more insights about small business trends on kaplancollectionagency.com. For companies that need capital quickly to keep growing, a brokerage can be a game-changer.

Here’s what sets this process apart:

- Rapid Decisions: You can often get a preliminary approval in as little as 24 hours.

- Fast Funding: Once approved, the capital can be in your account, often within 24 to 48 hours.

- Dedicated Support: You’re not going it alone. You get paired with an advisor who helps you compare offers and make sense of the terms.

Do You Qualify?

Eligibility is refreshingly straightforward. The focus is on your business's current health, not a perfect credit score from years ago. You can typically qualify if you meet these minimums:

- 1+ year in business

- $10,000+ in monthly revenue

Don't let a past rejection from a bank stop you from solving your working capital challenges. A streamlined, no-obligation application is your first step toward getting the capital you need to stabilize operations and fuel your next stage of growth.

Ready to see what's possible? Take a few minutes to start your application today and get a clear picture of the funding available to you.

Common Questions About Working Capital

Let's tackle some of the most frequent questions we hear from business owners about working capital. Getting these details right can make a world of difference.

How Much Working Capital Do I Really Need?

There's no one-size-fits-all answer here, because every business is different. What works for a construction company won't work for a retail shop.

However, a good rule of thumb is to shoot for a working capital ratio between 1.2 and 2.0. This range suggests you can comfortably cover your immediate bills and still have a safety net, but you aren't letting too much cash sit idle that could be invested back into the business.

What's the Difference Between a Working Capital Loan and a Line of Credit?

Think of it like this: a working capital loan is a one-time cash infusion for a specific, planned project. You get a lump sum upfront and pay it back over a set period. It's perfect for something like buying a large inventory order for the busy season.

A business line of credit, on the other hand, is like a credit card for your business. It's a revolving source of funds you can dip into whenever you need, pay back, and then use again. This offers incredible flexibility for managing the day-to-day ups and downs, like covering payroll during an unexpectedly slow month.

The key distinction lies in structure and purpose. A loan is for a singular, planned expense, while a line of credit is a flexible safety net for recurring cash flow needs.

Can I Get Funded With Bad Credit or as a New Business?

Yes, absolutely. While big banks might shut the door based on a low credit score or limited business history, many modern funding partners look at the bigger picture.

They often care more about the current health of your business—like consistent monthly revenue—than your past credit stumbles. For instance, options like a merchant cash advance are tied directly to your daily sales volume, not your personal FICO score. This opens up opportunities for many businesses that don't fit the traditional lending mold.

At FSE - Funding Solution Experts, we specialize in connecting businesses like yours with the right capital. Start your no-obligation application to explore your options. Learn more at https://www.fseb2b.com.