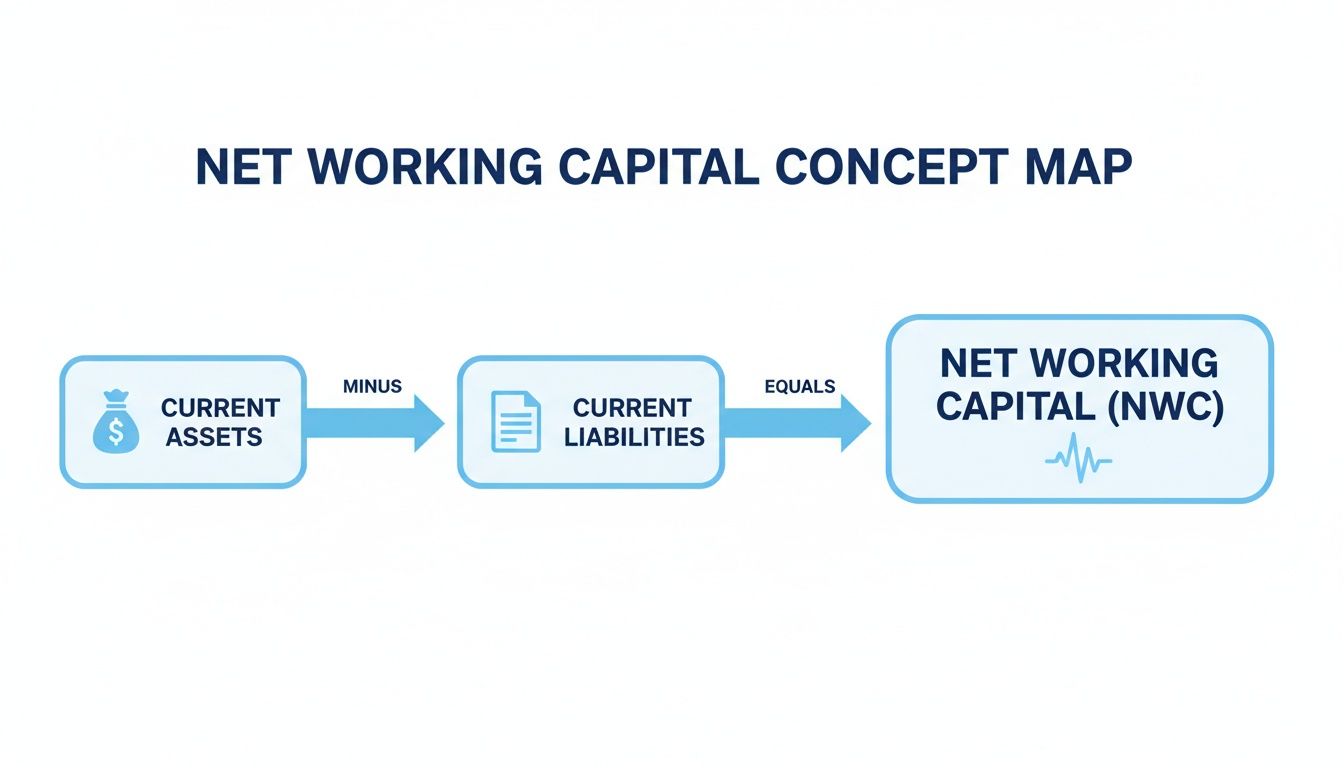

The net working capital formula is Current Assets - Current Liabilities. This simple calculation reveals your company's short-term financial footing and whether you have enough cash to cover upcoming bills.

Understanding Net Working Capital

Net working capital (NWC) measures your business's ability to handle its short-term finances. A positive NWC means you have enough liquid assets to pay immediate debts. A negative number signals a potential cash crunch. For businesses like construction or retail, where there's a lag between paying suppliers and getting paid, NWC is a critical survival metric.

Why the Formula Matters

Understanding your NWC gives you and potential lenders a clear snapshot of your:

- Operational Efficiency: A healthy NWC indicates strong management of inventory and receivables.

- Liquidity: It shows you can cover unexpected costs or seize growth opportunities.

- Financial Health: Consistent positive NWC signals stability to investors.

In essence, NWC answers the key question: "Do I have enough cash to cover my bills?" For small businesses, tracking this is vital for smart financial management. It helps you see cash flow shortages before they happen and build a strong case for funding. Learn more with our guide on working capital for small businesses.

Breaking Down the Formula Components

To use the net working capital formula, you must understand its two pillars: Current Assets and Current Liabilities. These are the building blocks of your business's short-term financial health.

Unpacking Your Current Assets

Current assets are resources your business can convert to cash within a year. They include:

- Cash and Cash Equivalents: Money in your business bank accounts.

- Accounts Receivable (A/R): Money customers owe you.

- Inventory: Raw materials and finished goods ready for sale.

- Prepaid Expenses: Bills paid in advance, like insurance.

Understanding the balance between payables and receivables is key to optimizing your balance sheet.

Understanding Your Current Liabilities

Current liabilities are short-term financial obligations due within one year. Common examples are:

- Accounts Payable (A/P): Money you owe to suppliers.

- Accrued Expenses: Incurred costs not yet invoiced, like salaries.

- Short-Term Loans: Debt payments due within the next 12 months.

The Standard Formula vs. Operating Working Capital

While the standard formula (Current Assets - Current Liabilities) provides a broad view, Operating Net Working Capital (ONWC) offers a focused look at operational efficiency. It strips out financial items like cash and short-term debt.

The ONWC formula is: (Accounts Receivable + Inventory) - (Accounts Payable + Accrued Expenses)

This version answers how well the core business generates cash from its main operations. For many small businesses, this focused calculation is especially powerful.

How to Calculate Net Working Capital with Real Examples

Applying the net working capital formula with real numbers makes the concept clear. This walkthrough shows how to calculate NWC and what the results mean for a company's ability to operate smoothly.

Example 1: A Business with Positive NWC

Let's look at a firm with healthy finances.

| Current Assets | Amount | Current Liabilities | Amount |

|---|---|---|---|

| Cash | $150,000 | Accounts Payable | $120,000 |

| Accounts Receivable | $250,000 | Accrued Payroll | $60,000 |

| Inventory | $80,000 | Short-Term Loan | $20,000 |

| Total | $480,000 | Total | $200,000 |

The calculation: $480,000 (Assets) - $200,000 (Liabilities) = $280,000 (Positive NWC)

This healthy buffer means the company can easily cover its bills and handle unexpected costs.

Example 2: A Business with Negative NWC

Now, a business facing a cash crunch.

| Current Assets | Amount | Current Liabilities | Amount |

|---|---|---|---|

| Cash | $20,000 | Accounts Payable | $150,000 |

| Accounts Receivable | $10,000 | Accrued Expenses | $25,000 |

| Inventory | $180,000 | Short-Term Credit | $40,000 |

| Total | $210,000 | Total | $215,000 |

The calculation reveals a problem: $210,000 (Assets) - $215,000 (Liabilities) = -$5,000 (Negative NWC)

With negative NWC, the business lacks enough liquid assets to cover its immediate debts, a major red flag for lenders. For most businesses, this signals a serious cash flow issue.

Example 3: A Seasonal Business

A seasonal business, like a resort, sees its NWC fluctuate.

- Peak Season: High cash and receivables lead to a strong positive NWC (e.g., $90,000).

- Off-Season: Low cash reserves and fixed costs can result in a negative NWC (e.g., -$15,000).

This swing is manageable with proper planning, such as using summer profits to cover the winter deficit or securing a line of credit.

What Your Net Working Capital Numbers Really Mean

Your NWC number is a direct signal of your business's short-term health and efficiency. It tells lenders how much of a financial cushion you have.

Decoding a Positive Net Working Capital

Positive NWC means your current assets exceed your current liabilities. This is the goal for most businesses. It signals:

- Financial Stability: You can meet immediate obligations.

- Growth Potential: You can act on opportunities without emergency funding.

- Lender Confidence: You appear as a lower-risk borrower.

However, an excessively high NWC may mean your assets aren't being used effectively to generate profit.

Understanding Negative or Zero Net Working Capital

Negative NWC means your current liabilities are greater than your current assets, often signaling a cash crunch. Zero NWC means they are perfectly matched, leaving no room for error. A consistently low or negative NWC is a major concern for lenders.

The Current Ratio: A Lender's Perspective

Lenders often use the Current Ratio (Current Assets / Current Liabilities) for a standardized measure of liquidity. A healthy ratio typically falls between 1.2 and 2.0.

- Below 1.0: Indicates negative NWC and potential liquidity issues.

- Between 1.2 and 2.0: Generally considered the ideal range.

- Above 2.0: May suggest inefficient use of assets.

You can learn more from this in-depth analysis of working capital trends. Pairing this knowledge with metrics like the Days Inventory on Hand formula provides deeper insight into managing assets.

Practical Strategies to Improve Your Working Capital

If your NWC isn't ideal, you can take action. Improving working capital involves hands-on adjustments to boost liquidity and strengthen your balance sheet. The goal is to get paid faster, hold less unsold inventory, and pay your own bills strategically.

Accelerate Your Cash Inflows

Getting paid faster is one of the quickest ways to boost NWC.

- Offer Early Payment Discounts: Motivate clients to pay sooner.

- Tighten Your Invoicing Process: Send clear invoices immediately.

- Implement a Stricter Credit Policy: Vet new customers to avoid late payers.

Optimize Your Inventory Management

For businesses with stock, unsold inventory is trapped cash.

- Liquidate Slow-Moving Stock: Mark down products that haven't sold in 90+ days.

- Adopt Just-in-Time (JIT) Principles: Order goods to arrive right when needed.

- Improve Demand Forecasting: Use sales data to prevent overstocking.

Strategically Manage Your Accounts Payable

Be strategic about paying your own bills without paying late.

- Negotiate Better Terms: Ask key suppliers for longer payment windows (e.g., 45-60 days instead of 30).

- Prioritize Payments: Pay critical suppliers first and use full payment terms for others.

Use Financing to Your Advantage

Sometimes, operational tweaks aren't enough. The right financing provides an immediate injection of working capital. For more ideas, see our guide on how to improve business cash flow.

Common solutions include:

- Revolving Line of Credit: A flexible pool of funds for seasonal dips or unexpected costs.

- Invoice Factoring: Sell outstanding invoices to get cash immediately, shortening your cash cycle.

Improving Your Net Working Capital

| Strategy | Impacts This Component | How It Improves NWC | Best For Businesses That... |

|---|---|---|---|

| Offer early payment discounts | Current Assets (A/R) | Converts receivables into cash faster. | Have B2B clients and need to speed up cash conversion. |

| Liquidate old inventory | Current Assets (Inventory) | Turns slow-moving inventory into cash. | Are in retail and struggle with overstocking. |

| Negotiate longer supplier terms | Current Liabilities (A/P) | Keeps cash in your business longer. | Have strong supplier relationships. |

| Secure a line of credit | Current Assets (Cash) | Provides an immediate cash injection. | Experience seasonal cash flow fluctuations. |

Blending these strategies can turn working capital from a worry into a powerful asset.

Leveraging Working Capital to Unlock Funding

Understanding the net working capital formula is key to business growth. A firm grasp of your NWC turns your balance sheet into a roadmap for getting funded. When you can clearly explain your working capital position, you are better positioned to find the right financial partner. Traditional banks can be rigid, but a dedicated funding advisor can analyze your situation to find a flexible solution.

From Calculation to Capital

A funding expert bridges the gap between understanding your NWC and getting cash. They know how to read the story your numbers tell and find lenders who see your potential. This is especially true for businesses in fast-moving industries like logistics or construction.

Since 2018, the FSE network has successfully funded over $500M for more than 1,500 businesses—many turned down by traditional banks because of their NWC.

For a home services firm, this knowledge provides a competitive edge to secure a working capital line of credit fast. A skilled advisor can get a decision in as little as 24 hours. Your understanding of NWC is the key—now it’s time to unlock the door.

Your Top Questions About Net Working Capital, Answered

Here are answers to common questions about the net working capital formula.

Can a Business Actually Survive with Negative NWC?

Yes, but it's rare. A grocery store, for example, receives cash instantly from customers but may have 30-60 days to pay suppliers. This creates a cash cycle that supports negative NWC. For most other businesses, like a B2B service, consistently negative NWC is a major red flag indicating an inability to cover immediate bills.

How Is Net Working Capital Different from Cash Flow?

This is a critical distinction.

- Net working capital is a snapshot of your balance sheet at one point in time. It measures liquidity on paper.

- Cash flow is a movie showing the movement of actual cash over a period.

You can have positive NWC (e.g., high accounts receivable) but negative cash flow if customers haven't paid yet. A healthy business needs both.

How Often Should I Calculate My Net Working Capital?

You should calculate NWC at least monthly to spot trends and anticipate cash shortages. For seasonal businesses, a weekly calculation during peak and off-seasons provides even greater control and a clearer financial picture.

Mastering the net working capital formula empowers you to strengthen your company’s finances and seek funding with confidence. If your analysis reveals a gap, the advisors at FSE - Funding Solution Experts can help you find the right financing for your growth.